BLOG

A Buyer’s Guide to Biochar Carbon Credits: Making Smarter Choices

Introduction: Why Biochar Carbon Credits Are in the Spotlight

If you are a company, investor, or sustainability officer thinking about how to reach net zero, you’ve probably come across the term biochar carbon credits. Biochar projects are attracting attention because they combine two powerful benefits: durable carbon removal and co-benefits for soil, agriculture, and local communities.

Unlike many traditional offsets that simply avoid emissions, biochar locks carbon into a stable form for hundreds of years through pyrolysis. The resulting carbon is stored in solid form, often used to improve soil fertility or even replace polluting products.

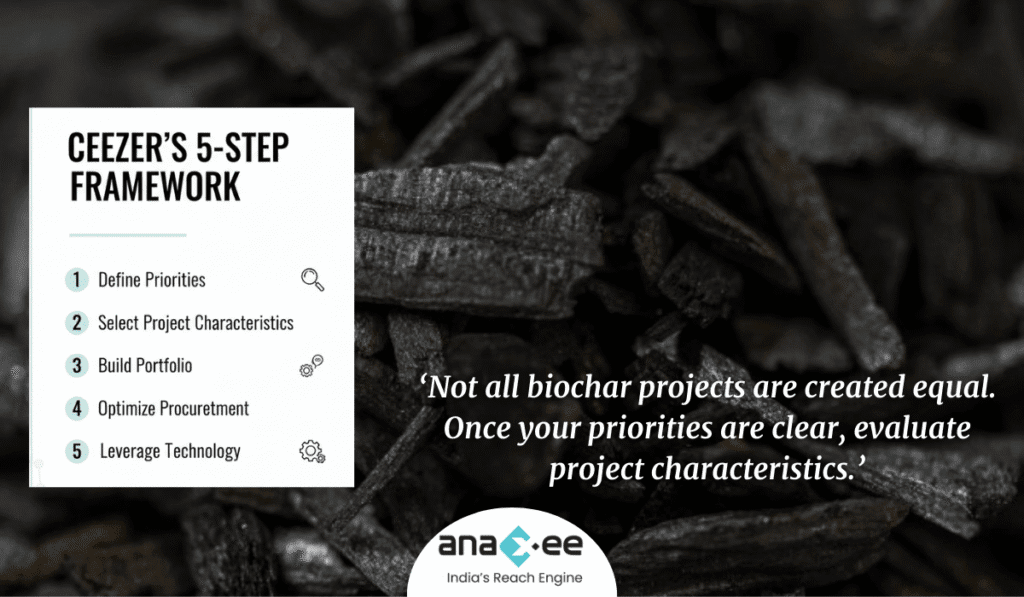

But here’s the catch: not all biochar projects are the same. The voluntary carbon market is still evolving, and buyers often face challenges like inconsistent quality, limited supply, and complex risk factors. Making the right decision requires a framework — and that’s where CEEZER’s 5-step approach comes in handy.

In this guide, we’ll walk you through:

Defining your priorities as a carbon credit buyer

Selecting project characteristics that fit your goals

Building a diversified biochar portfolio

Optimizing your procurement strategy

Leveraging technology for transparency and impact

By the end, you’ll have a roadmap to buy biochar carbon credits with confidence, while ensuring your investments align with long-term carbon credit procurement strategy and net zero commitments.

Step 1: Define Your Priorities

Every company has unique sustainability goals. Before you start scouting projects, pause and ask: What does success look like for your organization?

Possible Buyer Priorities:

-Durability of Removal: Is your priority long-term storage (100+ years)? Biochar offers strong permanence compared to nature-based solutions like afforestation.

-Scalability: Do you need large volumes now, or are you comfortable with smaller, growing projects that can scale over time?

-Co-Benefits: Do you want your credits to also support farmers, rural employment, or degraded land restoration?

-Cost Efficiency: Are you under pressure to optimize budgets and buy affordable credits, or do you want to invest in premium, high-integrity projects?

-Geographic Relevance: Do you want local projects (for community storytelling) or global sourcing for better supply diversification?

👉 Example: A food and beverage company sourcing crops from India might prioritize biochar credits generated locally, since they directly improve farmer livelihoods and soil quality in the supply chain.

Step 2: Select the Right Project Characteristics

Not all biochar projects are created equal. Once your priorities are clear, evaluate project characteristics.

Key Factors to Assess:

Feedstock Type

-Agricultural residues, forestry waste, or urban biomass.

-Risk: Unsustainable sourcing could undermine climate impact.Pyrolysis Technology

-Small-scale kilns vs. industrial units.

-Advanced units improve carbon yield and reduce methane leaks.Carbon Removal Permanence

-Biochar generally locks carbon for 100–1000 years.

-Check certification standards like Puro.earth or Verra for validation.Co-Benefits

-Soil health, crop productivity, reduced fertilizer use.

-Community jobs and local entrepreneurship.Verification & Certification

-Choose projects with third-party MRV (Monitoring, Reporting, Verification).

-Certification ensures credibility.

Step 3: Build a Diversified Biochar Portfolio

Just like financial investments, diversification reduces risk. Instead of relying on a single project, build a portfolio that balances cost, risk, and impact.

Why Diversification Matters:

-Supply risks: Projects may under-deliver on promised volumes.

-Technology risks: Early-stage pyrolysis units may face breakdowns.

-Market risks: Prices fluctuate as supply-demand evolves.

Portfolio Approach:

-Mix of geographies: India, Africa, Europe.

-Mix of project sizes: Established industrial plants + emerging farmer-led models.

-Mix of co-benefits: Some focused on soil, others on renewable energy co-products.

👉 Example Portfolio:

-40% credits from large-scale European biochar producers (high certainty).

-40% from farmer-led Indian agroforestry biochar projects (community co-benefits).

-20% from experimental urban biomass-to-biochar pilots (innovation exposure).

Step 4: Optimize Your Procurement Strategy

Now that you know what to buy, it’s time to think about how you buy. Procurement strategies can make or break your impact.

Approaches to Procurement:

Spot Buying

-One-off purchase when credits are available.

-Pros: Flexibility.

-Cons: Higher prices, supply uncertainty.Forward Contracts

-Buy credits from future vintages (1–5 years ahead).

– Pros: Price security, supports project financing.

– Cons: Delivery risks.Blended Procurement

– Mix spot and forward to balance risks.

Partnerships & Direct Investments

-Collaborate with project developers.

– Secure long-term supply and shape project design.

👉 Tip: Many buyers combine 30–40% spot purchases with forward agreements for stability.

Step 5: Leverage Technology for Transparency and Impact

One of the biggest challenges in carbon markets is trust. Buyers want to know:

-Are the credits real?

-Is the carbon truly stored?

-Are communities benefiting?

This is where technology-driven MRV becomes essential.

How Tech Helps in Biochar Projects:

-Geo-tagging: Each biochar application site can be mapped.

-Digital Runners & Field Data Collection: Platforms like Anaxee ensure on-ground monitoring at scale.

-Satellite Imagery: Verifies land use change and soil impact.

-Blockchain or Registry Tech: Tracks credits transparently to prevent double-counting.

Managing Risks in Biochar Carbon Credits

No guide is complete without risk management. Buyers should be aware of:

-Permanence Risk: Though durable, improper application/storage could degrade biochar.

-Methodology Risk: Inconsistent standards across registries.

-Market Risk: Price volatility as biochar supply scales.

-Delivery Risk: Small projects may fail to deliver promised volumes.

👉 Mitigation Tip: Diversify, choose verified projects, and maintain ongoing monitoring.

Conclusion: Smarter Choices for Net Zero

Buying biochar carbon credits is not just a compliance move — it’s a strategic decision that can:

-Lock away carbon for centuries

-Improve soil health and agricultural resilience

-Support rural livelihoods

-Strengthen your net zero strategy

By following CEEZER’s 5-step framework — define priorities, select project characteristics, diversify your portfolio, optimize procurement, and leverage technology — buyers can make informed, resilient, and impactful choices.

As demand for high-quality carbon removals grows, those who build smart procurement strategies today will lead the way tomorrow.

About Anaxee:

Anaxee drives large-scale, country-wide Climate and Carbon Credit projects across India. We specialize in Nature-Based Solutions (NbS) and community-driven initiatives, providing the technology and on-ground network needed to execute, monitor, and ensure transparency in projects like agroforestry, regenerative agriculture, improved cookstoves, solar devices, water filters and more. Our systems are designed to maintain integrity and verifiable impact in carbon methodologies.

Beyond climate, Anaxee is India’s Reach Engine- building the nation’s largest last-mile outreach network of 100,000 Digital Runners (shared, tech-enabled field force). We help corporates, agri-focused companies, and social organizations scale to rural and semi-urban India by executing projects in 26 states, 540+ districts, and 11,000+ pin codes, ensuring both scale and 100% transparency in last-mile operations.

Partner with Anaxee for your Net ZERO goals! Connect at sales@anaxee.com