BLOG

CCTS Draft 2025: India’s Top Paper & Pulp Plants and Their Carbon Targets

India’s Paper Industry and the Carbon Market: CCTS 2025 Explained:

What’s Happening?

With the CCTS Draft Notification of June 2025, India’s government has put a hard number on how much CO₂ the biggest industrial plants are allowed to emit- measured in GHG Emission Intensity (GEI). This includes the pulp & paper industry, which now joins steel, cement, and fertilizers under India’s formal carbon market umbrella.

Each listed paper unit has been:

-Assigned a baseline GEI (tonnes of CO₂ per tonne of paper produced),

-And a reduction target for the next two years: 2025–26 and 2026–27.

If they go above the target — they’ll have to buy carbon credits.

If they beat it — they can earn and sell credits.

Simple rules. Big implications.

Why the Paper Industry?

Paper may look clean, but the process behind it is energy-heavy and carbon-intensive.

Here’s why India’s pulp and paper sector matters for climate action:

| Factor | Impact |

| Biomass & Coal | Many plants still rely on solid fuels for steam & heat. |

| Water-heavy process | Adds energy use via pumping, treating, heating. |

| Captive power | Many have internal plants running on coal or furnace oil. |

| Process emissions | Pulping, bleaching, and drying steps are GHG intensive. |

India’s paper sector is estimated to emit 10–15 million tonnes of CO₂ annually. That’s more than the entire emissions of Bhutan.

Full List: India’s Major Paper Plants Under CCTS 2025

Here’s a table of the 20 paper & pulp plants across India included in the CCTS Draft. This includes both private and government-linked manufacturers.

| No | Plant | State | Baseline_Output_tonnes | Baseline_GEI_tCO2_per_t | Target_GEI_2025_26 | Target_GEI_2026_27 |

| 1 | Ballarpur Industries – Ballarpur Unit | Maharashtra | 137222 | 2.38 | 2.34 | 2.31 |

| 2 | JK Paper Ltd – Rayagada Unit | Odisha | 136226 | 2.13 | 2.1 | 2.07 |

| 3 | West Coast Paper Mills – Dandeli | Karnataka | 167432 | 2.42 | 2.38 | 2.35 |

| 4 | Tamil Nadu Newsprint & Papers Ltd (TNPL) | Tamil Nadu | 385688 | 1.88 | 1.85 | 1.82 |

| 5 | Century Pulp & Paper – Lalkuan | Uttarakhand | 375523 | 2.56 | 2.52 | 2.48 |

| 6 | ITC Ltd – Bhadrachalam Paperboards | Telangana | 122296 | 2.12 | 2.09 | 2.06 |

| 7 | Emami Paper Mills – Balasore | Odisha | 156139 | 2.86 | 2.82 | 2.77 |

| 8 | Naini Papers – Kashipur | Uttarakhand | 249081 | 1.66 | 1.64 | 1.61 |

| 9 | Yash Pakka Ltd – Ayodhya | Uttar Pradesh | 309747 | 1.75 | 1.72 | 1.7 |

| 10 | NR Agarwal Industries Ltd – Vapi | Gujarat | 176575 | 2.71 | 2.67 | 2.63 |

| 11 | Kuantum Papers Ltd – Saila Khurd | Punjab | 175399 | 1.22 | 1.2 | 1.18 |

| 12 | Orient Paper & Industries Ltd – Amlai | Madhya Pradesh | 254457 | 2.27 | 2.24 | 2.2 |

| 13 | Star Paper Mills Ltd – Saharanpur | Uttar Pradesh | 347243 | 1.35 | 1.33 | 1.31 |

| 14 | Seshasayee Paper & Boards – Erode | Tamil Nadu | 176673 | 2.43 | 2.39 | 2.36 |

| 15 | Andhra Paper Ltd – Rajahmundry | Andhra Pradesh | 101315 | 1.52 | 1.5 | 1.47 |

| 16 | The Andhra Pradesh Paper Mills – Kadiyam | Andhra Pradesh | 143852 | 2.69 | 2.65 | 2.61 |

| 17 | Abhishek Industries – Trident Paper Division | Punjab | 368839 | 1.43 | 1.41 | 1.39 |

| 18 | Bindals Papers Mills Ltd – Muzaffarnagar | Uttar Pradesh | 243992 | 2.89 | 2.85 | 2.8 |

| 19 | Genus Paper & Boards Ltd – Moradabad | Uttar Pradesh | 305774 | 1.8 | 1.77 | 1.75 |

| 20 | Pudumjee Paper Products – Pune | Maharashtra | 352265 | 2.45 | 2.41 | 2.38 |

What the Table Tells Us

-GEI values range from 1.0 to 3.0 tCO₂/t — a huge variation showing gaps in technology.

-The biggest plants (like TNPL, ITC Bhadrachalam, Century Pulp) have better economies of scale and likely lower GEI.

-Several Uttar Pradesh units (Muzaffarnagar, Moradabad) appear on the list—this region is paper-dense but tech-light.

-Odisha and Tamil Nadu dominate the east and south belt.

What These Targets Mean (Financially)

Let’s break it down for one plant.

Example: JK Paper – Rayagada

-Output: 1.3 lakh tonnes

-GEI (2023–24): 2.13

-Target (2026–27): 2.07

-Gap = 0.06 tCO₂/t

Total excess = 1.3 lakh × 0.06 = 7,800 tCO₂

If carbon price is ₹1,200 per tonne → ₹93.6 lakh liability

But if they beat the target? That’s ₹93.6 lakh in credit revenue.

Multiply that by 20 plants and 2 years — the total opportunity/liability is in hundreds of crores.

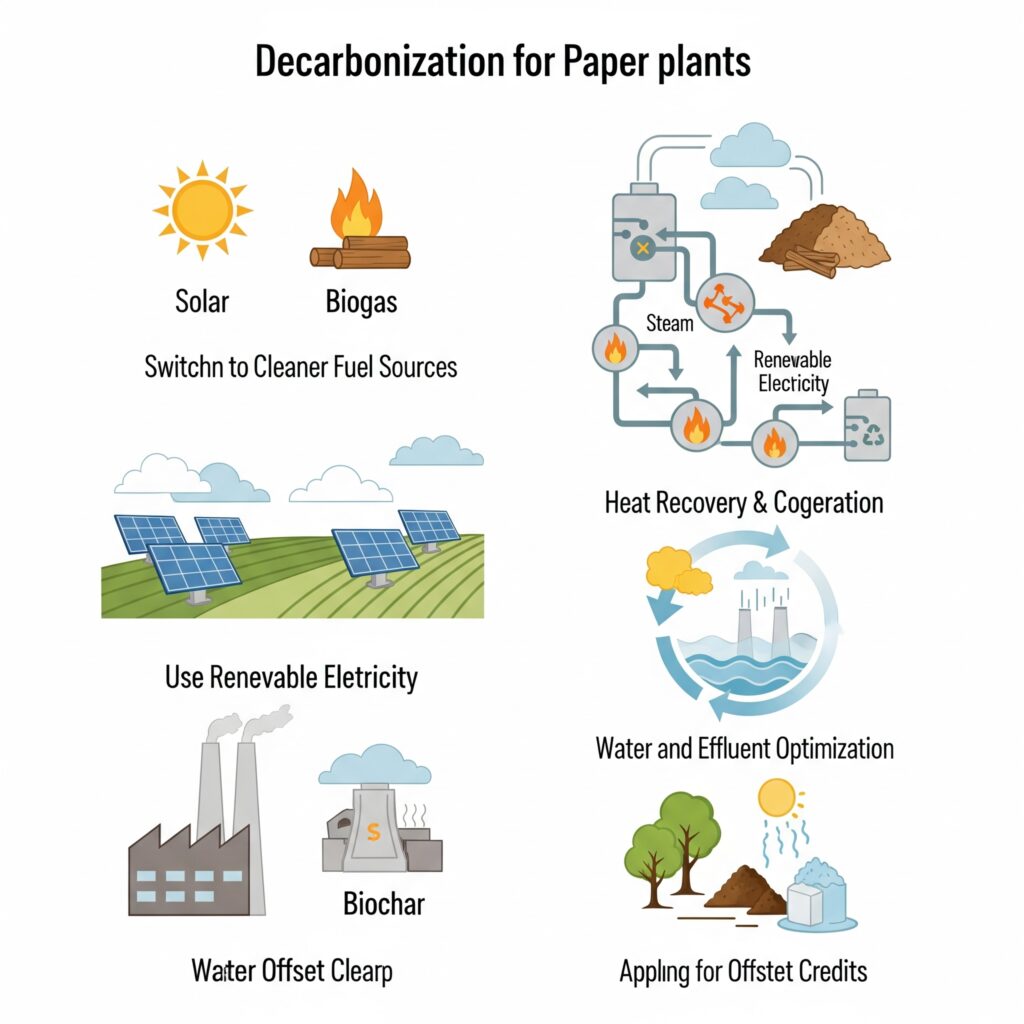

What Can Paper Plants Do?

You can’t just “green” a paper mill overnight. But here’s what leading units are doing:

1. Switch to Cleaner Fuel

-Biomass → Biogas → Green hydrogen (long term)

-TNPL has shifted to 100% biomass boiler ops in some units.

2. Heat Recovery & Cogeneration

-Steam traps, condensate recovery, waste heat boilers

-Century Pulp saved ~11% of energy this way.

3. Switch to Renewable Electricity

-3–5 MW solar for daytime pulp section

-Paper drying still remains hard to decarbonize

4. Water & Effluent Optimization

-Energy saved per kL treated = ~0.5–0.8 kWh

-Naini Papers has reduced water use by 30% over 5 years.

5. Apply for Offset Credits

-Agroforestry (in sourcing regions)

-Biochar (from paper sludge waste)

-Wastewater methane recovery

Who Might Struggle?

| Plant | Risk Factor |

| Bindals (Muzaffarnagar) | Older tech, lower automation |

| Genus Paper (Moradabad) | Wastepaper recycling may still emit |

| Orient Paper (MP) | High coal usage, legacy system |

Who Could Be Sellers?

| Plant | Why? |

| TNPL | Biomass-fed, green-energy leaning |

| Century Pulp | High efficiency, newer systems |

| JK Paper | Consistent upgrade cycles, RE investments |

What’s the Role of Anaxee?

Anaxee can help these plants earn credits, monitor emissions, and verify offsets with its all-India last-mile network. Especially for:

-Agroforestry credit documentation

-Paper sludge → biochar projects

-Capturing ground-level RE projects for MRV

-GPS & timestamped field data for validation

📍 Your verifier needs field photos?

📍 Need to geo-tag saplings at 200 locations?

📍 Want to track methane from sludge lagoons?

Anaxee does it—digitally, on time, at scale.

Final Thoughts

India’s paper mills are stepping into carbon accounting for the first time. The CCTS framework is a wake-up call, but also an opportunity.

Companies that embrace energy efficiency and credit tracking early will profit.

Those who delay?

They’ll be stuck buying credits from those who didn’t.

Want to Track Your Carbon & Earn Credits?

If you’re a paper manufacturer or a consultant working with mills — talk to Anaxee’s Climate Team, at sales@anaxee-wp-aug25-wordpress.dock.anaxee.com

We’ll help you:

-Monitor your GEI

-Launch a real offset project (Nature based Projects)

-And verify everything, ground-up.

About Anaxee:

Anaxee is India’s Reach Engine! we are building India’s largest last-mile outreach network of 100,000 Digital Runners (shared feet-on-street, tech-enabled) to help Businesses and Social Organisations scale to rural and semi-urban India, We operate in 26 states, 540+ districts, and 11,000+ pin codes in India.

We Help in last-mile execution of projects for (1) Corporates, (2) Agri-focussed companies, (3) Climate, and (4) Social organizations. Using technology and people on-the-ground (our Digital Runners), we help in scale and execute projects across 100s of cities and bring 100% transparency in groundwork. We also work in the Tech for Climate domain, providing technology for the execution and monitoring of Nature-Based (NbS) and Community projects. Our technology & processes bring transparency and integrity into carbon projects across various methodologies (Agroforestry, Regen Agriculture, Solar devices, Improved Cookstoves, Water filters, LED lamps, etc.) worldwide.