BLOG

Corporate Leadership Convening on India’s Carbon Market: Key Mumbai Takeaways & What They Mean for Anaxee

Corporate Leadership Convening on the Indian Carbon Market: Mumbai Reflections & Anaxee’s Way Forward

When the Environmental Defense Fund (EDF) and Mahindra Group invited corporate leaders to Mumbai for a half‑day deep‑dive on India’s nascent Carbon Credit Trading Scheme (CCTS), we booked our tickets immediately. India’s carbon market architecture is being finalized right now; decisions made in 2025 will hard‑wire opportunity—or friction—into every project we run for the next decade. As a last‑mile execution partner that brings data fidelity to rural carbon projects, Anaxee needed to be in the room.

The Corporate Leadership Convening: Opportunities & Strategies for Corporates in the Indian Carbon Market promised three things we care about:

Clarity on the rule‑book – How will the Indian Carbon Market (ICM) balance compliance and offset mechanisms?

Signals on pricing & competitiveness – What carbon‑price range are Indian CFOs running in their scenarios?

A reality check from peers – What’s keeping large emitters up at night, and where do they see openings for technology partners?

The agenda packed these promises into two high‑intensity hours, followed by an equally high‑intensity networking lunch.

2. Scene‑Setter: India’s Carbon Market Moment

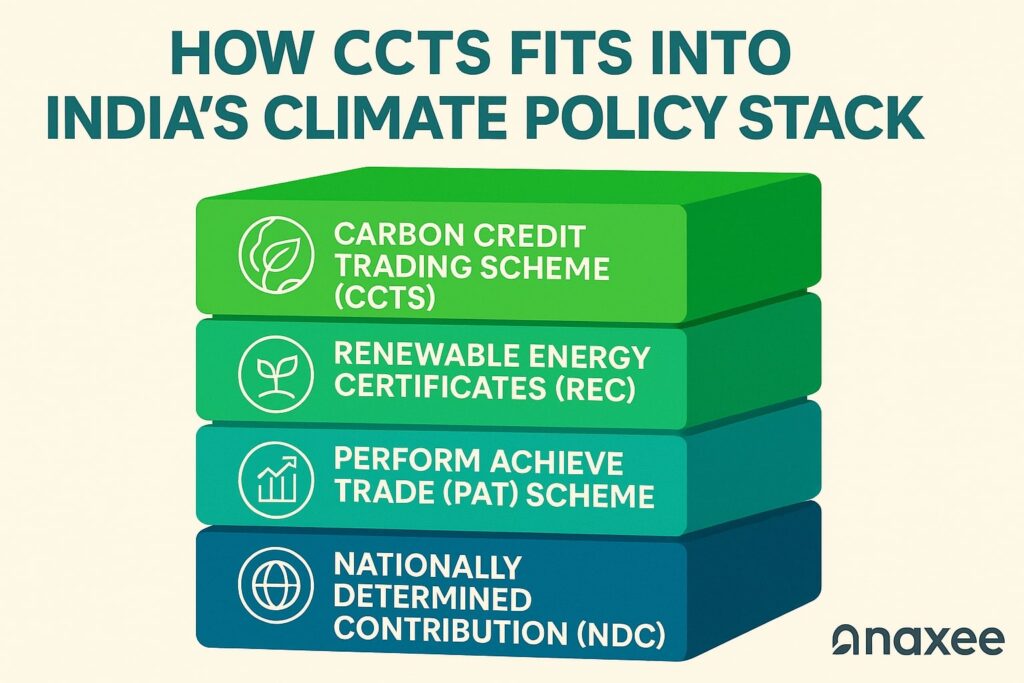

India has declared its ambition to be the first major economy to industrialise without carbonising. Lofty? Yes. Impossible? No—if the incentives line up. The CCTS is the incentive engine. Nine high‑emitting sectors will face intensity targets under Phase I. That means every tonne we help save through credible NbS or tech‑based projects could soon have a domestic buyer mandated to retire it.

But the stakes run deeper:

-$7‑12 trillion in green investment by 2050 (3‑6 % of projected GDP) is on the line.

-Compliance credits will co‑exist with voluntary credits. The quality bar cannot afford to drop or the entire market will stall.

-Indian corporates must not just comply; they must stay competitive against peers operating in older, more liquid markets such as the EU ETS.

3. Decoding the Programme

Below is how the morning unfolded (our shorthand notes next to each slot):

| Time | Session | Speaker(s) | Anaxee Take |

| 10:30 | Opening & framing | Ankit Todi (CSO, Mahindra) | Positioned corporate leadership as deal‑maker or deal‑breaker for ICM integrity. |

| 10:40 | Carbon Markets 101 | István Bart (EDF) | Compared compliance vs voluntary markets globally; highlighted data‑tracking headaches. |

| 10:55 | Strategic framing | Pedro Barata (EDF) | Laid out how Article 6‑ready firms secure cheaper capital. |

| 11:10 | Carbon‑pricing responses worldwide | Darcy Jones (EDF) | Case studies of firms that turned carbon costs into R&D triggers. |

| 11:25 | Legal‑financial lens on credits | Parthsarathi Jha (ELP) | Ownership and tax treatment still grey; expect jurisprudence within 24 months. |

| 11:40 | Q&A: Corporate challenges | Panel with industry | Top worry: availability of high‑integrity domestic supply. |

| 12:25 | Wrap‑up & path forward | Ankit Todi | Called for pilot trades under “sandbox” rules before full launch. |

(Agenda verbatim lines sourced from event brief.)

4. Five Things We Learned (and What We’ll Do About Them)

Carbon price discovery will be messy. Early ICM auctions may clear below ₹800 / tCO₂e. That’s not enough to unlock agroforestry at scale, so we must keep bringing costs down through tech‑enabled, census‑based monitoring rather than waiting for price spikes.

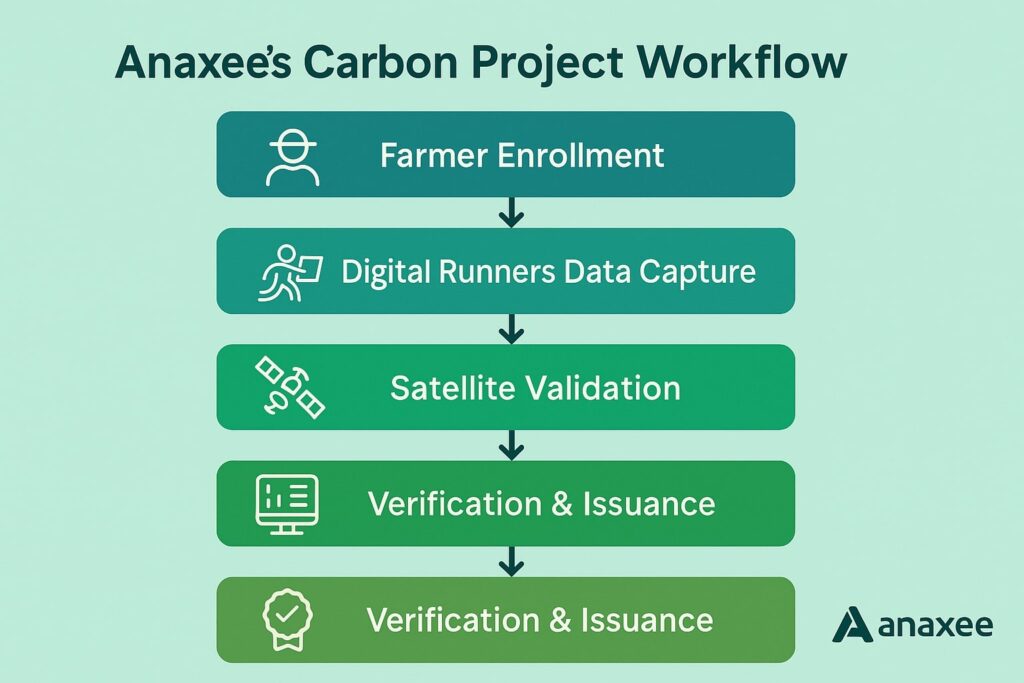

Data is the new collateral. EDF speakers hammered home that auditors and financiers now treat verifiable data streams as risk mitigants. Anaxee’s runner‑network already captures plot‑level imagery and metadata; next step is integrating MRV dashboards directly with broker platforms.

Article 6 alignment is non‑negotiable. Even if initial CCTS phases stay domestic, exporters in steel and cement fear CBAM‑type border adjustments. Projects with dual eligibility (ICM + Article 6) will command a premium. Our SOP designs will therefore over‑comply with IC‑VCM Core Carbon Principles from day one.

Legal clarity is two steps behind market momentum. Ownership questions—especially when credits derive from distributed smallholders—remain unresolved. We’re drafting farmer consent templates that anticipate future jurisprudence rather than react to it.

Corporate treasuries are ready, but sceptical. Cash is waiting on the sidelines; the bottleneck is confidence in supply integrity. That’s precisely the credibility gap dMRV platforms like ours can plug.

5. Deep Dive: Session Highlights

5.1 Opening by Ankit Todi

Ankit’s blunt opener—“If we design a weak market, no one wins”—set the day’s no‑nonsense tone. He argued that sustainability teams must speak CFO language: risk‑adjusted IRR, not just tonnes avoided. We couldn’t agree more, but we’d add that CFOs also need field reality checks: many rural mitigation projects carry social licence risks that spreadsheets miss.

5.2 István Bart — Compliance vs Voluntary

István dissected how ETS pilots in Vietnam and Indonesia borrow best practices from EU ETS, yet still struggle with MRV. Key graph: EU ETS allowance volatility vs average monitoring cost per tonne. Our takeaway: Indian policymakers must budget for MRV capacity‑building, otherwise verification bottlenecks will choke supply.

5.3 Pedro Barata — Strategy Lessons

Pedro’s slides on “carbon as competitive lever” resonated. Companies that internalised a shadow price early (Ørsted, Microsoft) now book lower long‑term capital costs. For Anaxee, the signal is clear: we should pitch carbon‑resilient supply chains, not just credits.

5.4 Darcy Jones — Corporate Responses

Darcy showed that firms incorporating carbon costs into capex decisions outperformed peers by 4‑6 % EBITDA over five years. But she warned of “green‑hush,” the backlash when claims outrun evidence. Our field‑photo verification protocol addresses exactly that credibility gap.

5.5 Parthsarathi Jha — Legal Grey Zones

Parthsarathi listed three unresolved issues: (i) whether carbon credits count as “securities”; (ii) GST applicability on forward trades; (iii) double‑taxation risk across state lines. Until rulings arrive, contracts must bake in flexibility for tax treatment changes—something we’re now revisiting in all new PPAs.

6. Anaxee’s Action Plan Post‑Mumbai

| Priority | Why It Matters | 90‑Day Actions |

| dMRV Integration | Data credibility will make or break ICM. | Pilot satellite + runner photo triangulation on 5 000 ha of bund plantations. |

| Article 6 Readiness | Export‑facing sectors demand credits with international fungibility. | Map existing SOPs to IC‑VCM guidelines; identify gaps. |

| Farmer Consent 2.0 | Legal clarity still pending. | Draft template contracts that anticipate future securities classification. |

| Price Scenario Planning | CCTS price curve uncertain. | Build financial model with ₹500/ ₹800/ ₹1 500 scenarios; stress‑test IRR. |

| Stakeholder Education | CFOs & procurement still climbing learning curve. | Host three webinars with EDF speakers for our client base. |

7. Critical Reflections

Too Many Polite Questions. Q&A barely scratched scope‑3 integration or small‑cap access to offset finance. Future convenings must bring suppliers and MSMEs into the room.

Article 6 Elephant in the Hall. While everyone name‑checked the Paris Agreement, concrete guidance on corresponding adjustments was thin. Indian authorities must clarify double‑claiming rules before investors step in.

MRV Talent Shortage. Several attendees admitted they can’t find auditors familiar with both ISO 14064 and domestic forestry protocols. This is a training gap we’re keen to fill via our Climate Training Academy.

8. Where Do We Go from Here?

India is late to the carbon‑market party but carries size advantage. If we get integrity right, ICM credits could set a new benchmark. If we don’t, we risk an oversupply of low‑trust units mirroring the boom‑and‑bust of early CERs.

For Anaxee, the path is clear:

-Double‑down on transparency tech that slashes MRV cost per hectare.

-Bridge boardroom‑to‑farm with bilingual dashboards that translate carbon jargon into farmer income projections.

-Push for policy clarity by sharing our field data with BEE and EDF to inform baseline and leakage factors.

Walking out of Mahindra Towers, the message was clear: the window to build a credible Indian carbon market is open, but it will not stay open for long. Anaxee is positioning to keep that window propped open—through data‑driven transparency, farmer‑first project design, and relentless focus on integrity.

We’re ready to partner with corporates who see carbon not as a compliance headache but as a strategic lever. Let’s get this right—while the carbon price is still in rupees, not regret.

Have feedback or want to explore a pilot? Reach out to us at sales@anaxee-wp-aug25-wordpress.dock.anaxee.com.