BLOG

Investment Structures for Carbon Projects: Sources of Capital and Financing Models

Investment Structures and Sources of Capital for Carbon Projects

Introduction

Carbon projects, whether reforestation, mangrove restoration, or clean cookstoves, need money to get off the ground. While the environmental logic may be clear, the financial logic often isn’t. Developers struggle to secure early capital, investors weigh uncertain returns, and communities wait to see if promised benefits arrive. Financing is one of the biggest bottlenecks in scaling carbon markets.

The Carbon Finance Playbook identifies the range of investment structures and capital sources that make these projects possible. In this blog, we’ll unpack how carbon projects are financed, the investors involved, and the tools that can de-risk investments while ensuring long-term impact.

Why Investment Structures Matter

Carbon projects have different timelines, cashflow patterns, and risks depending on whether they are capital-light (like REDD+ forest protection) or capital-intensive (like reforestation or blue carbon). The right financing model must match:

-Upfront capital needs.

-Time to credit issuance.

-Revenue predictability.

-Community involvement.

Choosing the wrong financing structure can result in stranded projects or disappointed investors.

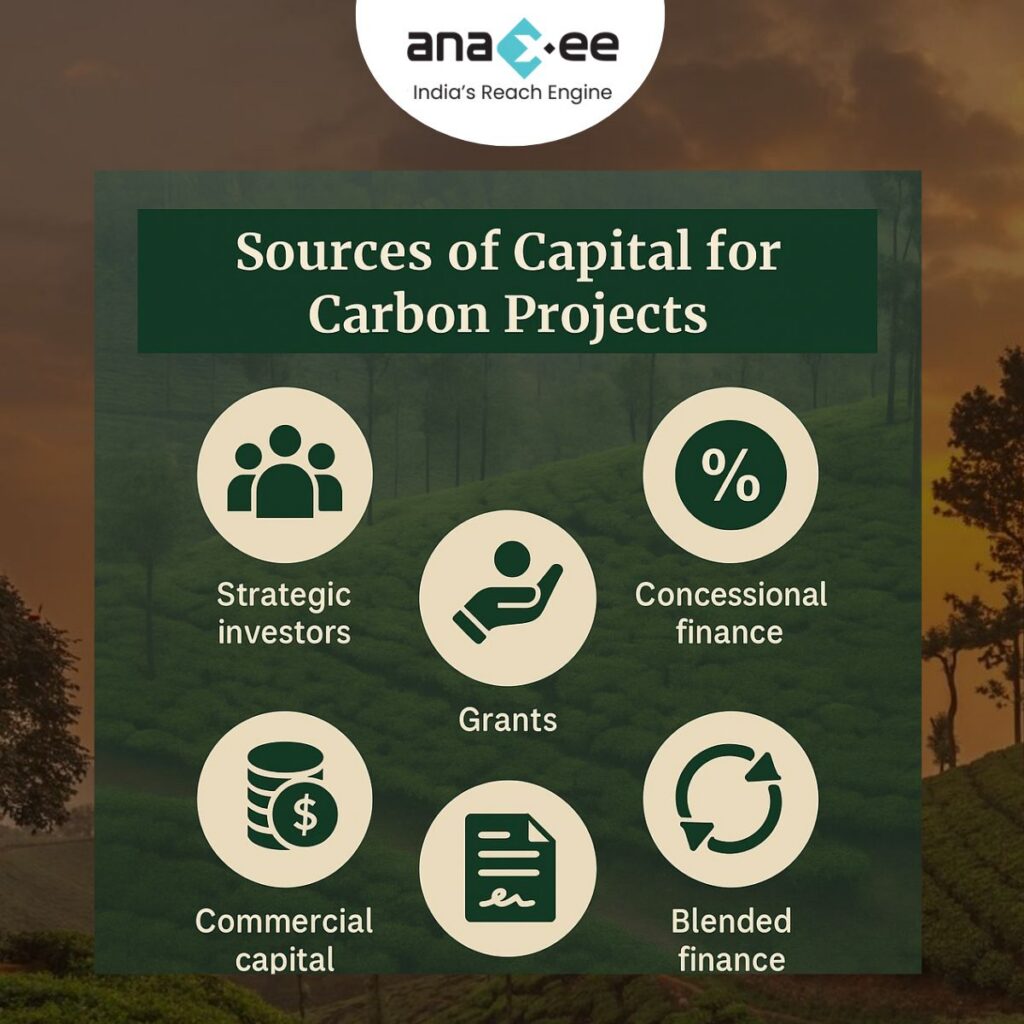

Sources of Capital for Carbon Projects

1. Strategic Investors

-Corporates that rely on carbon credits to meet net-zero goals.

-Often invest directly in projects to secure long-term credit supply.

-Example: Multinational firms partnering with African reforestation projects.

2. Grants and Philanthropic Capital

-Cover early-stage costs like feasibility studies, community engagement, or MRV.

-Non-repayable, but limited in scale.

-Example: Foundations funding cookstove distribution pilots.

3. Concessional Finance

-Includes low-interest loans or risk-sharing instruments from development banks.

-Attracts private capital by absorbing part of the risk.

-Example: African Development Bank offering concessional debt for solar irrigation linked to carbon credits.

4. Commercial Capital

-Private equity, venture capital, or debt investors.

-Seeks risk-adjusted returns; often reluctant to invest without risk mitigation.

-Example: Climate-focused VC funds supporting biochar startups.

5. Carbon Offtake and Pre-Sale Agreements

-Buyers purchase future credits at fixed prices.

-Provides upfront capital but often at a discount.

-Example: A reforestation project selling credits at $10/ton via offtake, even if spot markets later rise to $25/ton.

6. Blended Finance

-Combines donor grants, concessional finance, and commercial investment.

-Reduces risk and attracts larger pools of capital.

-Example: Cookstove projects scaling with donor grants plus private carbon revenue.

Financing Instruments

Different financial tools structure capital flows:

-Equity: Investors take ownership stakes in project developers. High risk, but potential high return.

-Debt: Loans repaid with interest, suitable for projects with predictable revenue.

-Results-Based Finance (RBF): Payments triggered when verified results are delivered (like certified credits).

-Revolving Funds: Community funds where credit revenue is reinvested locally.

-Carbon-Backed Securities: Credits packaged into financial products, offering liquidity to investors.

Matching Structures to Project Archetypes

Capital-Light Projects (e.g., REDD+)

-Require modest upfront investment.

-Suited to revenue-sharing, equity, or offtake contracts.

-Cashflows start within 1–2 years.

Capital-Intensive Projects (e.g., Reforestation, Blue Carbon)

-High upfront costs for planting and maintenance.

-Suited to blended finance, concessional loans, or equity.

-Longer payback (8–15 years).

Product-Linked Projects (e.g., Cookstoves, Solar Irrigation)

-Depend on scaling adoption.

-Suited to results-based finance, carbon subsidies, and revolving funds.

-Revenue streams combine product sales and credits.

Case Examples

SunCulture (Kenya)

Combined carbon subsidies with concessional finance to make solar irrigation affordable. Pre-sale of credits reduced upfront costs.

Cookstove Programs in India

Used blended finance with philanthropic support for distribution, followed by revenue from credits to sustain operations.

Reforestation in Latin America

Secured offtake agreements with European corporates, locking in early revenue but at discounted credit prices.

Challenges in Financing Carbon Projects

- Price Uncertainty: Volatile carbon markets make forecasting difficult.

- High Transaction Costs: Feasibility studies, community consultations, and MRV add up.

- Regulatory Ambiguity: Unclear carbon rights discourage investors.

- Trust Deficit: Negative press about integrity reduces willingness to commit capital.

- Long Timelines: Projects may take 5–10 years before credit issuance ramps up.

Risk Mitigation in Financing

To attract capital, projects and investors use tools such as:

-Insurance Products: Guarantee credit delivery even if projects underperform.

-Concessional Blends: Reduce downside risk for commercial investors.

-Transparency in Benefit Sharing: Improves credibility and reduces social risk.

-Standardization: Core Carbon Principles help define quality and integrity.

The Role of Donors, Investors, and Corporates

-Donors: Provide early grants and de-risking tools.

-Investors: Bring in capital once risks are reduced.

-Corporates: Anchor demand by signing offtake contracts or investing directly in projects.

Together, they create a financing ecosystem where each actor plays a role at different project stages.

The Future of Carbon Project Finance

-Article 6 Alignment: May open compliance demand and push prices higher.

-Green Bonds and Securities: Carbon credits could be bundled into larger financial markets.

-Digital Platforms: Tokenization and blockchain can improve liquidity and transparency.

-Impact Investing: Growing pool of capital seeking both returns and social-environmental outcomes.

Conclusion

Carbon projects cannot scale without capital, and capital will not flow without trust. The diversity of financing structures — from grants to blended finance to carbon-backed securities — reflects both the complexity and opportunity of this sector. By matching investment models to project archetypes, and by leveraging donor and concessional tools to reduce risk, emerging markets can unlock billions in climate finance.

The challenge ahead is to build financing ecosystems that are fair, transparent, and resilient. If done right, carbon project finance will not only deliver credits but also livelihoods, biodiversity, and a more sustainable global economy.

About Anaxee:

Anaxee drives large-scale, country-wide Climate and Carbon Credit projects across India. We specialize in Nature-Based Solutions (NbS) and community-driven initiatives, providing the technology and on-ground network needed to execute, monitor, and ensure transparency in projects like agroforestry, regenerative agriculture, improved cookstoves, solar devices, water filters and more. Our systems are designed to maintain integrity and verifiable impact in carbon methodologies.

Beyond climate, Anaxee is India’s Reach Engine- building the nation’s largest last-mile outreach network of 100,000 Digital Runners (shared, tech-enabled field force). We help corporates, agri-focused companies, and social organizations scale to rural and semi-urban India by executing projects in 26 states, 540+ districts, and 11,000+ pin codes, ensuring both scale and 100% transparency in last-mile operations. Connect with Anaxee at sales@anaxee.com