How Asia’s Largest Conglomerates Are Powering Net-Zero: What Indian Industry Can Learn from SK Group

1. Introduction: Why Look at SK Group Now?

As India rolls out the Carbon Credit Trading Scheme (CCTS) and more conglomerates declare net-zero ambitions, the real test lies in execution. Companies like Reliance, Adani, Tata, and JSW are making climate pledges—but who is already walking the talk?

South Korea’s SK Group is a compelling example. As the country’s second-largest conglomerate, SK is embedding climate strategy across its core businesses: energy, petrochemicals, renewables, and chemicals. While Indian corporates often silo green efforts into CSR or RE portfolios, SK’s model is integrated, time-bound, and strategic.

So, what can Indian industry learn from SK Group’s approach?

2. Who is SK Group?

-SK Group is South Korea’s 2nd-largest chaebol (business group) with over $130 billion in revenue.

-Its subsidiaries include SK Innovation (energy), SK E&S (clean energy), SK Chemicals, and SK Hynix (semiconductors).

– The group has pledged to achieve net-zero across operations and value chains.

SK is actively investing in clean tech, hydrogen, circular economy models, and low-carbon product lines, with a clear short-, medium-, and long-term roadmap.

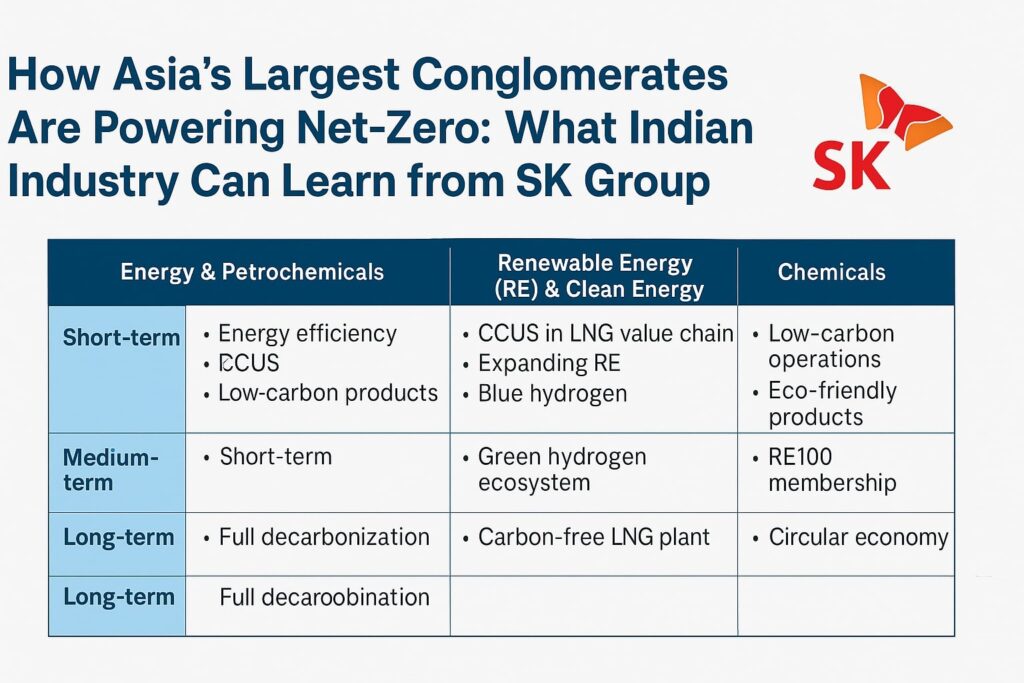

3. What SK Group Is Doing: A Sectoral and Time-Frame Breakdown

The group’s strategy can be summarized as a three-horizon play across three sectors:

A. Energy & Petrochemicals

Short-Term

-Improving energy efficiency

-Scaling renewable energy (RE)

-Developing low-carbon petrochemical products

-Driving EV battery production

Medium-Term

-Investing in green hydrogen production

-Deploying carbon capture, utilization, and storage (CCUS)

-Circular economy integration in energy flows

Long-Term

-Full decarbonization of the value chain

-Becoming a green materials and energy provider

-Mass adoption of hydrogen and net-zero fuels

B. Renewable Energy & Clean Energy

Short-Term

-CCUS integration in LNG value chains

-Expanding RE infrastructure (solar, wind)

-Producing blue hydrogen

Medium-Term

-Developing green hydrogen and supporting hydrogen ecosystems

-Purchasing nature-based carbon credits to offset hard-to-abate emissions

Long-Term

-Setting up carbon-free LNG power plants

-Becoming a global clean energy leader

C. Chemicals

Short-Term

-Eco-friendly production

-GHG reduction in chemical manufacturing

Medium-Term

-RE100 membership for SK Chemicals

-Eco-friendly copper foil production for electronics

Long-Term

-Circular economy model for the entire chemicals division

4. What Makes This Strategy Unique

Unlike many companies that treat ESG as a reporting obligation, SK Group:

-Aligns climate goals with core business profitability.

-Sets clear internal timelines across sectors.

-Integrates nature-based solutions (carbon credits) with tech-based decarbonization.

-Champions hydrogen not only as fuel but as a system-wide solution across transport, energy, and chemicals.

It’s a whole-of-conglomerate playbook. And India needs more of these.

5. What Indian Conglomerates Can Learn

| Conglomerate | Current Climate Moves | SK-Inspired Action Plan |

| Reliance | Green hydrogen, net-zero by 2035 | Add CCUS for petrochemicals, circular economy pilot |

| Adani | Solar parks, green ammonia | Commit to full value chain decarbonization |

| Tata | EVs, Tata Power RE projects | Unify sustainability and clean energy under one umbrella |

| Vedanta | Fragmented ESG reporting | Create sector-specific green roadmaps |

6. CCTS & Indian Climate Policy Context

India’s new CCTS mechanism demands verified emission reductions from industrial players. Like Korea’s ETS, it will pressure conglomerates to:

-Set internal carbon prices

-Plan abatement trajectories

-Explore offsetting through credits (RE, NbS, etc.)

SK’s nature-based carbon credit strategy is a signal that even large industrial groups see value in blending abatement + offsets.

7. Role of Anaxee: Tech for Climate

Anaxee can:

-Provide dMRV solutions for conglomerates investing in nature-based offset projects

-Enable traceable biomass supply chains for co-processing or CCUS feedstock

-Partner on verification frameworks aligned with CCTS

8. Conclusion: From Talk to Transformation

Indian conglomerates don’t lack intent—but they lack structured execution plans. SK Group shows that it’s possible to:

-Align business growth with decarbonization

-Integrate climate into capex, product, and policy strategy

-Leverage both nature-based and tech-based solutions

As CCTS takes off in India, SK Group’s three-horizon roadmap can inspire India Inc. to move from climate pledges to climate leadership.

About Anaxee:

Anaxee drives large-scale, country-wide Climate and Carbon Credit projects across India. We specialize in Nature-Based Solutions (NbS) and community-driven initiatives, providing the technology and on-ground network needed to execute, monitor, and ensure transparency in projects like agroforestry, regenerative agriculture, improved cookstoves, solar devices, water filters and more. Our systems are designed to maintain integrity and verifiable impact in carbon methodologies.

Beyond climate, Anaxee is India’s Reach Engine- building the nation’s largest last-mile outreach network of 100,000 Digital Runners (shared, tech-enabled field force). We help corporates, agri-focused companies, and social organizations scale to rural and semi-urban India by executing projects in 26 states, 540+ districts, and 11,000+ pin codes, ensuring both scale and 100% transparency in last-mile operations.

Ready to collaborate on your next Climate or Carbon project?

Email us at:sales@anaxee-wp-aug25-wordpress.dock.anaxee.com