BLOG

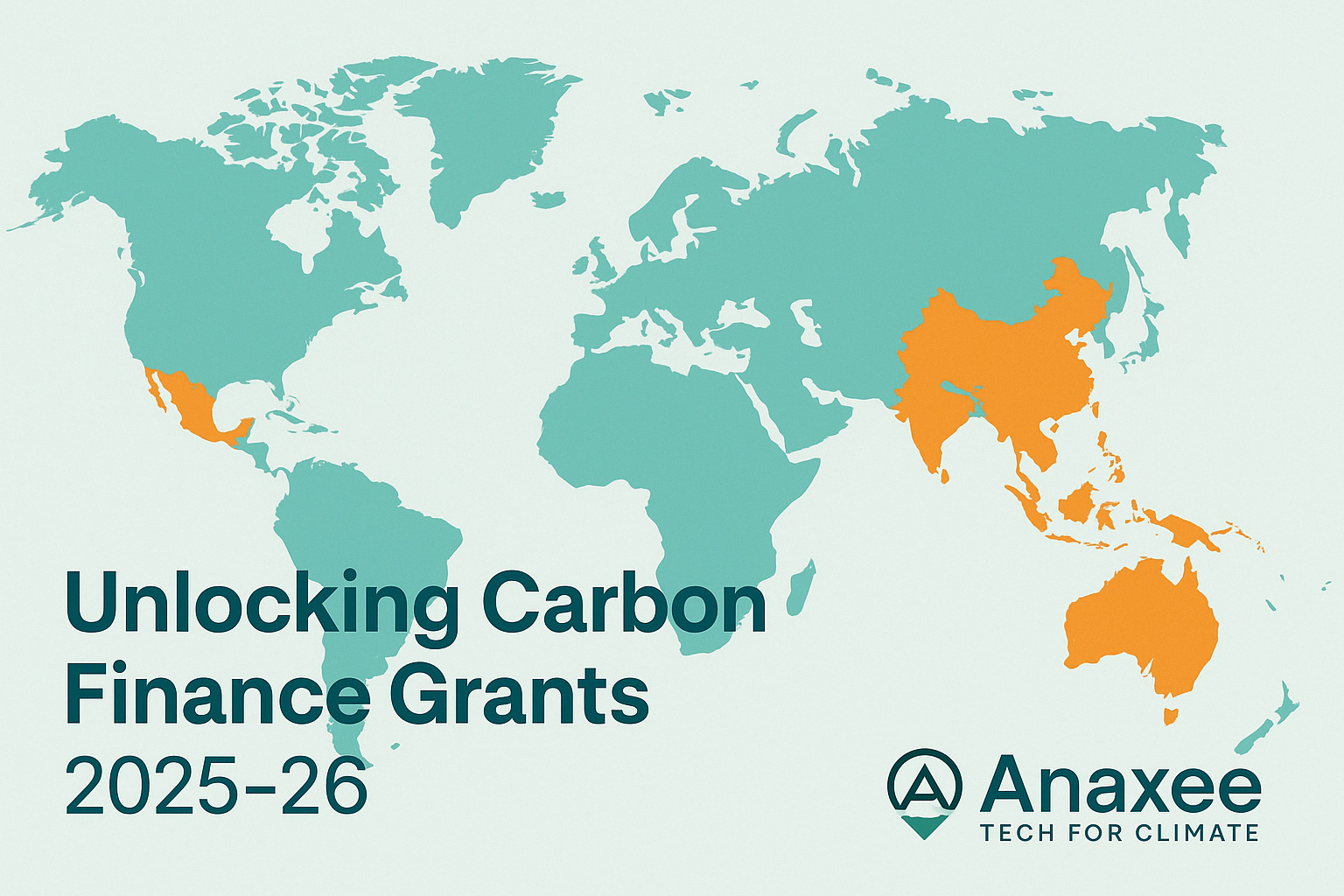

Unlocking Carbon Finance: 2025-26 Grant Opportunities Across India, Southeast Asia & Africa

Carbon finance isn’t short of capital- what’s scarce is deployable capital that covers the unglamorous, high-risk work of baseline studies, community consultations and early MRV. Grants and catalytic funds are the only money willing to write cheques before your first issuance of carbon credits.

If you’re a project developer, corporate sustainability lead, consultant or NGO hunting for that gap-filling cash in 2025-26, this post is your field guide. We dissect the most active windows- from Green Climate Fund readiness envelopes to niche blue-carbon accelerators- across three key geographies where climate finance demand outstrips supply: India, Southeast Asia and Africa.

Finally, we show where Anaxee’s 50,000-runner Reach Engine Network plugs in: from gathering plot-level data in Jharkhand’s agroforestry belts to verifying mangrove survival rates in Aceh. If you’re serious about turning a grant into bankable carbon revenue, last-mile execution and credible data are non-negotiable. That’s where we come in.

1. Why Grant Funding Still Matters in a $2 Billion Voluntary Carbon Market

Carbon credits may sell for USD 5–35 /tCO₂e, but nobody pays for your feasibility survey up-front. Commercial debt needs cash-flows; equity demands an exit. Grants absorb first-loss risk, unlock concessional lending and give you the data credibility to negotiate a forward-credit sale. That leverage ratio—often 1:10 or better—is why every serious developer still chases catalytic grants in 2025.

Reality check: If your pitch has no line-item for rigorous MRV or community benefit-sharing, expect rejection. Funders lost patience with “vague NbS pilots” circa 2023.

2. Five Global Windows You Can Hit from Anywhere

| Grant Window | Typical Ticket | Pays For | 2025-26 Status | Killer Criterion |

| Green Climate Fund – Readiness | USD 1 m /country/yr | Institutional capacity, PPF | New 4-yr cycle live | NDA alignment |

| Catalytic Climate Finance Facility | Up to USD 500 k | Blended-finance prototyping | Deadline 29 Aug 2025 | Clear path to private co-investment |

| Global Innovation Lab – Pre-Seed Capital | USD 200 k | Proof-of-concept financial mechanisms | Next cohort Jan 2026 | Mechanism must be replicable |

| Adaptation Fund – Small Grants | USD 250 k | Community NbS pilots | Rolling | Accredited entity sponsorship |

| Bezos Earth Fund – Nature & AI | Phase-1 USD 50 k, up to 2 m | AI-enabled NbS MRV | Q1 2026 full proposals | Novel AI use for verification |

(Full details—including pro-tips on scoring rubrics—appear later in each regional section.)

3. India: Where Policy & Capital Are Finally Converging

3.1 NAFCC 2.0 – Bigger Cheques, Sharper Scrutiny

NABARD’s National Adaptation Fund for Climate Change now caps at INR 25 crore (~USD 3 m) and explicitly rewards carbon co-benefits that align with the new Indian Carbon Credit Trading Scheme (CCTS).

– Winning angle: Bundle agroforestry or soil-carbon pilots with livelihood metrics; demonstrate Article 6 optionality.

3.2 UK PACT Urban Mobility & MRV Call (closes 28 Aug 2025)

Focus is low-carbon transport MRV, city-scale emission baselines and digital infrastructure. Grants GBP 300 k–1 m.

Pro-tip: UK partner not mandatory, but helps scoring.

4 Southeast Asia: Blended Money Meets Blue-Carbon Optimism

– ADB’s ASEAN Catalytic Green Finance Facility (ACGF): TA grants up to USD 5 m. Bonus points for projects that can absorb ADB concessional debt post-grant.

– UK PACT SEA Window (deadline 30 Jul 2025): Priority sectors: MRV systems, NbS standards.

– Blue Carbon Accelerator Fund (Q4 2025 call): AUD 250–400 k for mangrove/seagrass feasibility. Show a path to credit issuance <4 years.

5 Africa: Where Credibility Is Currency

-

SEFA (AfDB): Up to USD 1 m in TA + USD 10 m blended tranche. Bundle renewables with carbon-credit revenue to shine.

-

Africa Carbon Markets Initiative (ACMI): Catalytic grants USD 100–500 k – Q3 2025 call. Must commit to ICVCM Core Carbon Principles.

-

Africa Forest Carbon Catalyst (TNC): Bridge funding USD 100–300 k plus intense tech support—rare hand-holding that turns shaky REDD+ concepts into issuable projects.

6 How to Win: The Ugly Truth Funders Won’t Write on Their Websites

– MRV is do-or-die. Pull in a tech-enabled data partner early (spoiler: that’s us).

– Article 6 “optionality” = brownie points. Show them you can pivot from VCM to bilateral compliance sales.

– Leverage ratio matters. Every USD of grant should crowd at least USD 4 of follow-on capital.

– Co-benefits are weighted. Most scoring matrices assign ≥25 % to gender, livelihood and biodiversity impact.

– Speed still counts. If your E&S and permit work drags beyond 12 months, money will walk.

7 Where Anaxee Delivers Non-Negotiable Value

| Pain Point | How Anaxee Closes the Gap |

| Granular Baseline Data in remote blocks | 50,000 tech-enabled Digital Runners collect geo-tagged plot data in 11,000+ Indian pincodes & expanding hubs in SEA & East Africa. |

| Community Engagement / FPIC | Local runners speak the dialects; they shorten consultation timelines and cut mistrust. |

| Real-time MRV | Anaxee’s Reach Engine syncs field data to cloud dashboards, feeding directly into Verra, Gold Standard or Article 6 registries. |

| Cost-Efficiency | Shared “feet-on-street” model beats hiring a bespoke field team—even before you secure the grant. |

| Proof for Funders | Transparent audit trails, immutable data logs, and API access simplify due-diligence for GCF, UK PACT or SEFA reviewers. |

8 Action Checklist (Save & Share)

-

Short-list 2–3 funding windows that fit your geography + project type.

-

Book a 30-min scoping call with Anaxee to map baseline data needs.

-

Draft a 3-page concept note—lead with tCO₂e potential, cost-per-ton, leverage ratio.

-

Align with host-country NDC targets; quote chapter & verse.

-

Lock in an accredited entity or not-for-profit sponsor (mandatory for GCF, Adaptation Fund, UK PACT).

-

Submit before the deadline—then start lining up co-finance while the reviewers deliberate.

Conclusion & Call-to-Action

Grants are a finite, fiercely contested pool—but the 2025-26 cycle is unusually rich. Whether you’re mapping a soil-carbon pilot in Madhya Pradesh or a mangrove project in Manila Bay, the windows above are writing cheques now.

Ready to turn a grant application into a revenue-grade carbon project?

Talk to Anaxee’s Tech for Climate team today. We bridge the last-mile gap between big funding promises and verifiable on-ground impact—so your term sheet doesn’t die in the “interesting concept” pile.