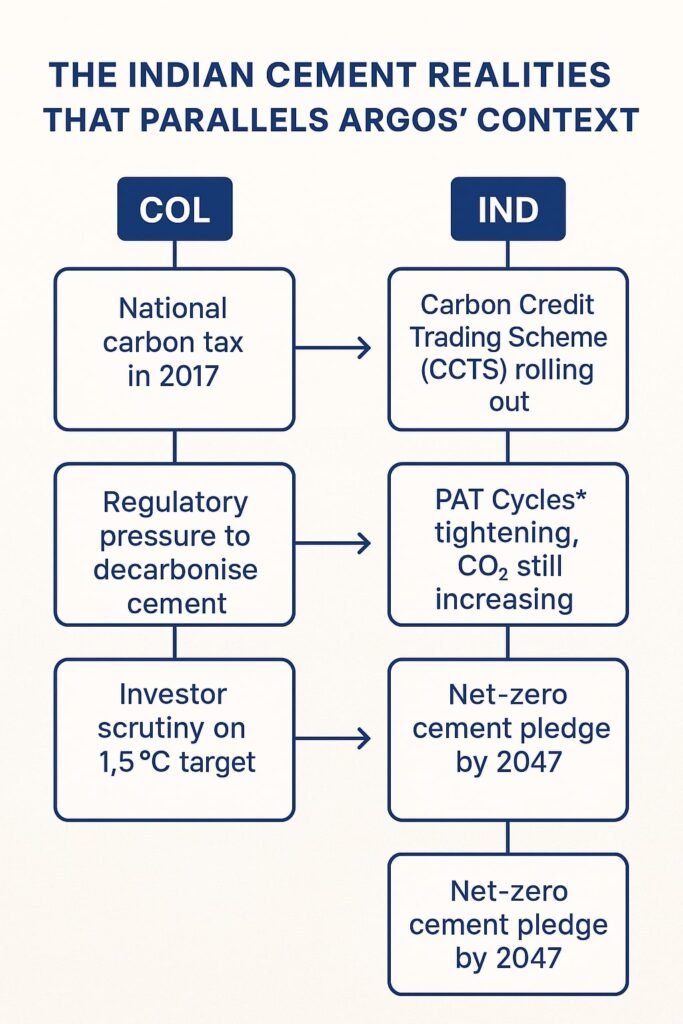

1. Why Look at Colombia When India Has Its Own Carbon Rules?

You could say Colombia and India are worlds apart. Yet Cementos Argos—Colombia’s largest cement maker—faced the same crossroads Indian producers meet today:

–A national carbon tax in 2017 and plans for an Emissions Trading System (ETS).

-Rising investor pressure for 1.5 °C‑aligned targets.

-Customers asking for greener cement.

India is now rolling out the Carbon Credit Trading Scheme (CCTS) and tightening PAT cycles. If Colombian cement could get ahead of regulation, why can’t we?

2. What Exactly Did Cementos Argos Do?

| Response Box on Slide | Real‑World Action | Evidence |

| “Began preparing before obligations were finalised” | Ran internal scenario workshops in 2016 while the carbon‑tax bill was still in Congress | Argos |

| “Built a cross‑departmental Climate Task Force” | Established a C‑suite–level task force that meets quarterly; KPIs cascade to plant managers | Argos |

| “Created a specialised unit within its sustainability department” | 25‑member Carbon & Energy team to collect data, model marginal‑abatement cost curves and scout tech | Argos |

| “Adopted an internal carbon price” | Started with USD 8/t CO₂ in 2018; stepped up to USD 40/t by 2024 for cap‑ex screening | Argos |

| “Used carbon pricing for cap‑ex decisions” | Cancelled one fossil‑fuel kiln retrofit, invested instead in a low‑clinker PLC line in Cartagena | |

| “Reduced carbon intensity by 13 % in five years” | Cut from 654 kg CO₂/ton clinker (2018) to 569 kg in 2023 | Argos |

Add‑ons outside the slide:

-Piloting carbon capture with Nuada under GCCA Innovandi.

-Low‑clinker ‘EcoStrong PLC’ cement in North America—clinker ratio cut from 89 % to 80 % in two years.

3. Where Does India Stand? A Quick Reality Check

-CCTS: Notification issued 2023; methodologies approved March 2025. Nine sectors—including cement—will face intensity targets first, then a cap‑and‑trade regime.

-PAT Cycle‑III results: Energy savings good, yet absolute CO₂ keeps rising as demand grows.

-Net‑zero pledge: 2070 for India, 2050 for many listed cement majors. Roadmap from GCCA‑India & TERI sets interim goal of net‑zero cement by 2047.

Bottom line? The rulebook is being written now—exactly the window Argos exploited.

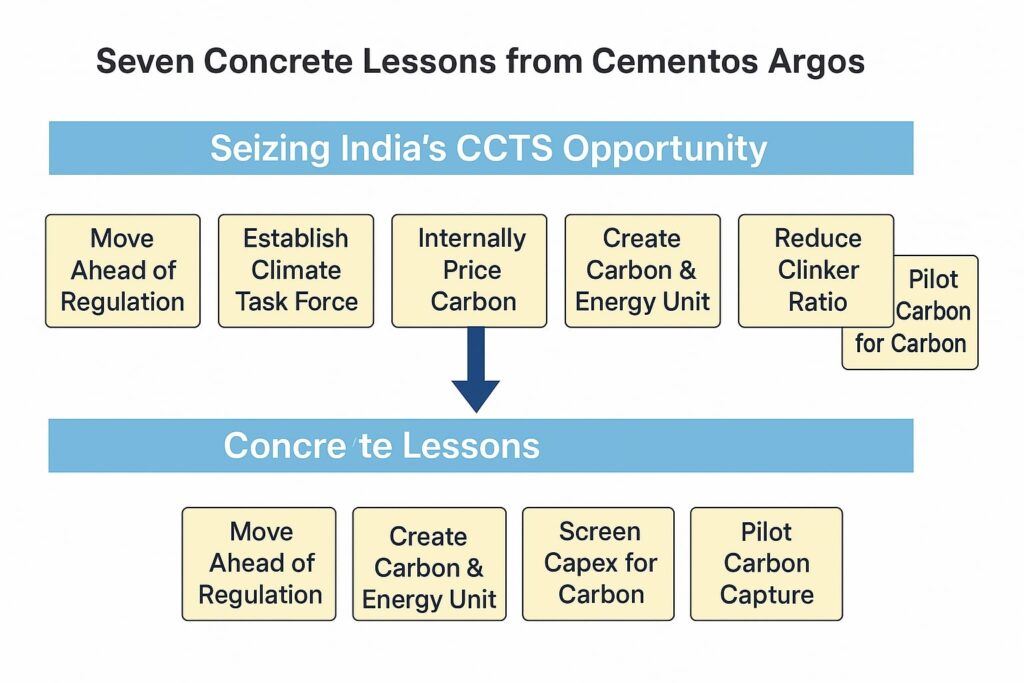

4. Seven Concrete Lessons for Indian Producers

4.1 Move Before the Hammer Falls

Argos started compliance prep one full year before the Colombian carbon‑tax rate was fixed. Indian firms can:

-Simulate CCTS penalties at INR 1 000–2 000/t CO₂.

-Run pilot MRV systems—don’t wait for Bureau of Energy Efficiency manuals.

4.2 Build a Cross‑Functional Climate Task Force

Siloed CSR teams won’t cut it. In Argos the Task Force links finance, operations, R&D and marketing; that integration drove faster decision‑making. Replicate with a chairperson reporting straight to the COO.

4.3 Put a Price on Carbon—Internally

Even a low shadow price disciplines investment. Start modest (say, INR 500/t) and ratchet up yearly. Use it to rank kiln upgrades, waste‑heat recovery, and alternative‑fuel retrofits.

4.4 Institutionalise a Carbon & Energy Unit

Data quality is India Inc.’s Achilles heel. A dedicated unit ensures:

-Plant‑level dashboards for clinker ratio, fuel mix, specific heat consumption.

-Alignment with ISO 14064 or GHG Protocol for audits.

4.5 Slash Clinker—Fast

Calcined clay, slag, and limestone fillers lowered Argos’ clinker factor. Indian context:

-Calcined clay: Abundant in Gujarat and Jharkhand.

-Granulated blast‑furnace slag: Tata Steel and JSW supply.

-Fly ash: Still ample despite coal‑plant phase‑down.

4.6 Treat Cap‑Ex as Climate‑Ex

Argos vetoed high‑carbon retrofits once carbon price went into the NPV. Indian boards should set a rule: “Projects above INR 50 crore must clear internal carbon hurdle.”

4.7 Bet on Carbon Capture Pilots

CCUS may feel distant, yet early pilots lock learning curves. Partner with Innovandi, IISc or BHEL‑NTPC JV for cement‑flue capture test rigs.

5. Deep Dive—Applying the Lessons Plant‑by‑Plant

| Plant Archetype | Typical Indian Scenario | Argos‑Style Play | Quick Win |

| Legacy Wet‑Process | 1970s kilns, high heat rate | Scrap wet line, install modern pre‑heater/pre‑calciner; justify with shadow carbon price | 15 % fuel cut |

| Integrated Dry Kiln + WHR | UltraTech‑type mega plants | Co‑processing RDF, biomass; sign green‑power PPAs | 100 kg CO₂/t cut |

| Standalone Grinding Unit | Imports clinker from parent plant | Push PLC (Portland Limestone Cement) or PSC blends; market as “low‑carbon” | Green‑premium pricing |

| New Brownfield Expansion | State clearances pending | Bake INR 1 000/t carbon price into IRR; choose calcined‑clay route | Avoid stranded assets |

6. Policy Tailwinds Indian Firms Can Ride

-CCTS Early‑Action Credits – Projects completed after Jan 2023 may qualify.

-Green Finance – SEBI’s new disclosure rules nudge lenders to favour low‑carbon CapEx.

-Production‑Linked Incentive (PLI) for Green Hydrogen – Opens door to hydrogen kiln pilots like Argos’.

-State RDF Mandates – Tamil Nadu & Rajasthan already require minimum RDF substitution in kilns.

Use them or lose them.

7. What Role Can Anaxee Play?

Anaxee’s last‑mile network can:

-

dMRV: Provide digital MRV for biomass supply chains to meet co‑processing traceability.

-

Community Biomass Aggregation: Aggregate agri‑waste for RDF or bio‑char feedstock.

-

Carbon‑Credit Origination: Package early‑action projects for voluntary market sales before CCTS kicks in fully.

8. Frequently Asked Questions

Q1. Will internal carbon pricing hurt profitability?

Short term maybe, long term it prevents stranded assets.

Q2. Isn’t CCUS too expensive?

Pilot scale costs are falling. Early movers get learning subsidies and first‑mover brand value.

9. The Road Ahead-A 12‑Month Checklist

| Month | Action | Owner |

| 1‑2 | Form Climate Task Force | MD & HR |

| 2‑3 | Issue internal carbon‑pricing memo | CFO |

| 3‑6 | Audit clinker factors & fuel mix | Plant Heads |

| 4‑8 | Identify one low‑clinker product line | R&D |

| 6‑9 | Sign MoU for CCUS pilot | BD & Tech |

| 9‑12 | File early‑action credit documents under CCTS | Sustainability |

10. Conclusion

Cementos Argos shows climate leadership is not an NGO talking point—it’s a profit‑shield in a carbon‑priced world. With CCTS already gazetted, Indian cement majors that copy Argos’ playbook today will dodge compliance shocks, capture green‑product premiums tomorrow, and—frankly—outrun the laggards.

Ready to future‑proof your plants? Let’s talk—Anaxee’s Tech‑for‑Climate team is one click away. Connect with us at sales@anaxee-wp-aug25-wordpress.dock.anaxee.com