Anaxee Emerges as a Climate-Change Frontrunner in the Developing World with High-Integrity Nature-Based Carbon Credits

1. Climate Finance’s Brutal Math

Developing economies need USD 359 billion per year just for climate adaptation- yet public flows reached only USD 28 billion in 2022, leaving a yawning gap. The mismatch is even starker for mitigation: analysts project demand for voluntary carbon credits could grow 15-fold by 2030, pushing the market well past USD 50 billion.

Shortfall + soaring demand = a unique moment for credible, nature-based carbon projects—if they can prove impact, fend off “green-washing,” and reach dispersed rural stakeholders.

2. Why Nature-Based Credits Still Matter—Integrity or Bust

– High Abatement Potential: NbS could deliver 30-40 % of the CO₂e reductions required for a Paris-aligned pathway.

– Cost Curve Advantage: Median delivery costs hover between USD 10-40 / tCO₂e- competitive even after recent market corrections.

– Co-Benefits: Restored soils, diversified farmer income, biodiversity gains- outcomes investors increasingly price in.

But integrity is non-negotiable. ICVCM’s new Core Carbon Principles and updated SBTi guidance tilt capital toward projects with transparent baselines, rigorous MRV, and community buy-in.

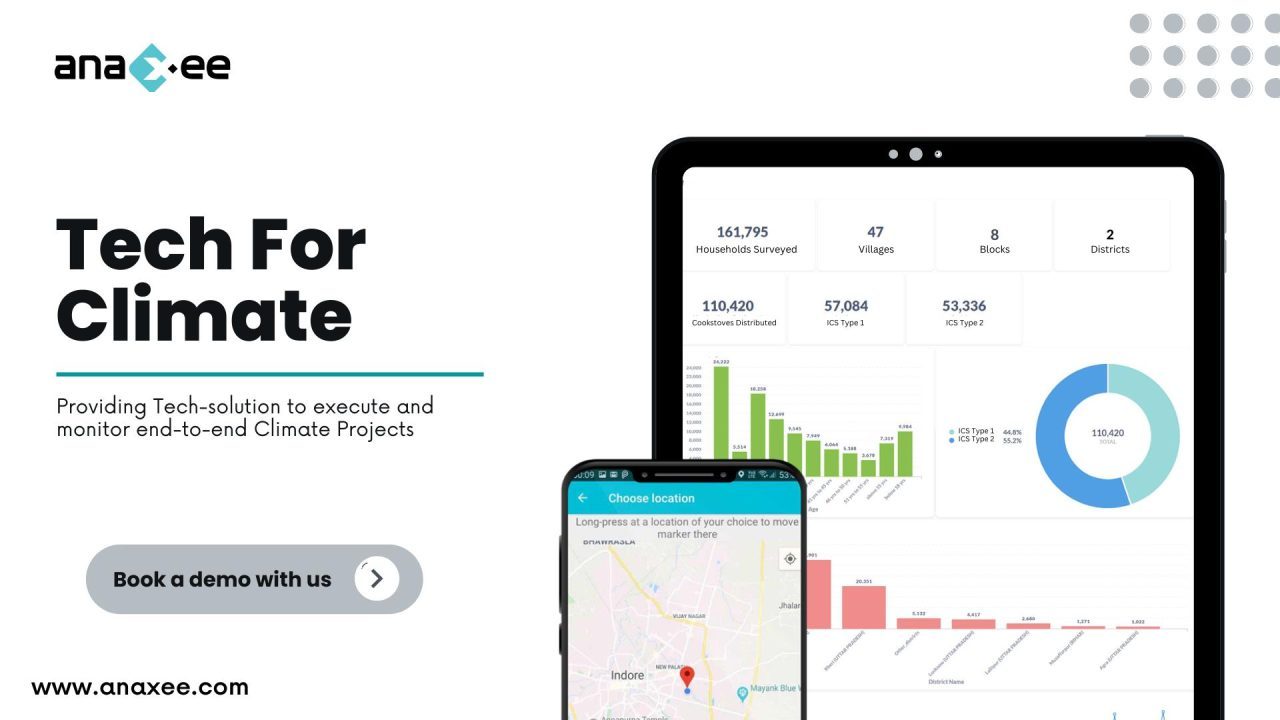

3. Meet Anaxee: India’s Climate Execution Infrastructure

India’s Reach Engine- 50,000 Digital Runners deployed across 26 states, 540+ districts, 11,000+ PIN codes.

Founded in Indore, Anaxee Digital Runners Pvt Ltd turns the hardest part of any carbon project—ground truth—into a repeatable service layer:

| Core Asset | What It Does | Why It Matters |

| Digital Runners | Community-embedded field agents with geo-tagged mobile app | Verifiable data, fluent local languages, instant scale-up |

| Tech for Climate™ Platform | Remote-sensing + drone imagery + AI tree-count + blockchain audit trail | End-to-end traceability that satisfies Verra, Gold Standard, CCTS, etc. |

| Last-Mile Ops | Logistics, training, distribution (e.g., 125,000 improved cookstoves delivered) | Converts registry paperwork into real-world impact |

Result: Anaxee delivers nature-based carbon projects that international buyers can audit, de-risk, and scale.

4. The Execution Gap- and How Anaxee Closes It

4.1 Farmer On-Ramp at National Scale

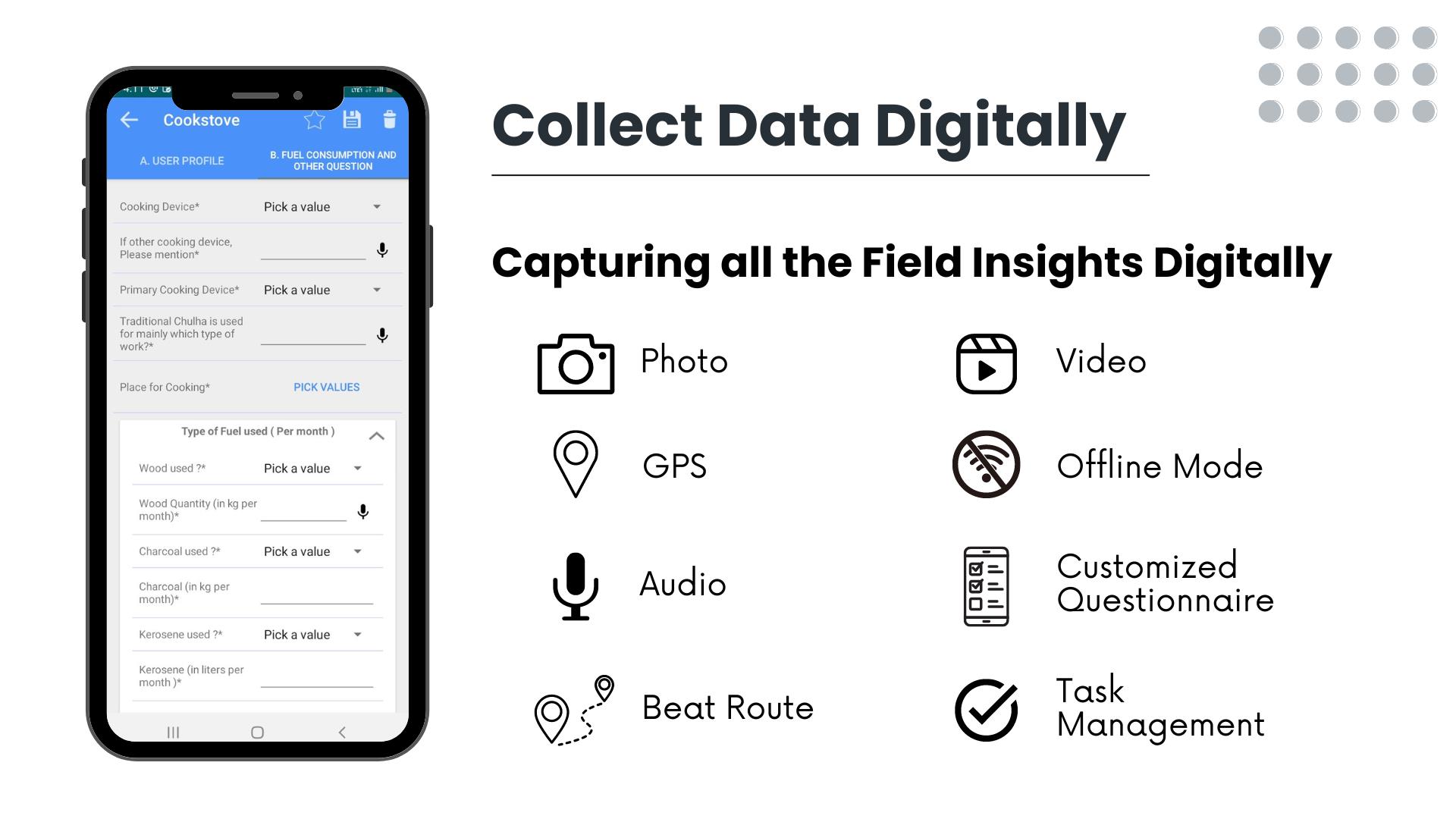

– Polygon-based land mapping within the mobile app

– Instant KYC + consent workflow in 11 regional languages

– In-app agronomy prompts nudging farmers toward regenerative practices

4.2 Transparent MRV

1. Baseline Survey → Digital Runners collect soil, biomass, and socio-economic data.

2. Remote-Sensing Layer → Sentinel-2/PlanetScope imagery feeds biomass & canopy models.

3. Continuous Monitoring → Periodic drone fly-overs; sensor data synced to immutable ledger.

4. Third-Party Audits → Data packets served via API to accredited auditors, reducing field costs by up to 40 %.

4.3 Benefit-Sharing Engine

Revenue split is codified in smart contracts- farmers see a direct wallet transfer when credits are issued, minimizing leakage risk and boosting adoption rates.

5. Portfolio Snapshot (2023-2025)

| Project | Geography | Methodology | Co-Benefits |

| Agroforestry | Madhya Pradesh, Maharashtra | Verra VM0047 | Soil fertility, shade crops |

| Cookstove Scale-Up | Madhya Pradesh, Maharashtra, Bihar | Gold Standard GS4GG | Health (PM₂.₅ ↓ 60 %), gender time-savings |

6. Tech for Climate™- Under the Hood

The platform is registry-agnostic: Anaxee pipes verified data directly into Verra’s project ID structure or GS Impact Registry, slashing lead times by 20–30 %.

7. Validation & Integrity Guardrails

– Standards: Verra, Gold Standard, CCB, CDM & emerging CCTS-India pathways

– Validation/Verification Bodies (VVBs): TÜV Rheinland, Climate Impact Partners, EPIC Sustainability

– Core Carbon Principles (ICVCM): Full alignment on baseline additionality, permanence buffers, and robust stakeholder consultation

Investors gain credits that clear the growing “quality filter” of institutional buyers—no stranded inventory risk.

8. Why Now? Three Macro Signals You Shouldn’t Ignore

-

Policy Tailwinds – India’s Carbon Credit Trading Scheme formally opens domestic demand in 2025, with exporters already prepping for a compliance top-up.

-

Market Integrity Reset – ICVCM’s Core Carbon Principles became live in March 2025; early movers securing “CCP-labelled” credits enjoy a price premium.

-

Supply-Demand Squeeze – McKinsey forecasts durable removal demand alone at 100 MtCO₂e by 2030; NbS demand could be higher even after conservatism discounts.

The upshot: high-quality nature-based credits from trusted platforms will not sit unsold.

9. Call to Action

Invest where impact meets execution.

Whether you’re a corporate chasing SBTi-aligned targets, an impact fund hunting credible returns, or a philanthropist scaling climate justice, Anaxee offers a pipeline that is execution-ready, traceable, and community-positive.

Ready to co-create climate impact at scale?

Reach us at sales@anaxee-wp-aug25-wordpress.dock.anaxee.com