Introduction: Beyond Short-Term Carbon

The world’s carbon removal efforts often focus on trees and soils — vital, but vulnerable. Trees can burn, soil carbon can erode. True climate impact needs durability — carbon that stays locked away for decades or even centuries.

This is where biochar and other soil amendments come in.

Biochar is a stable, carbon-rich material produced by heating organic matter (like crop residues, wood waste, or manure) under low oxygen — a process called pyrolysis. When applied to soils, biochar not only improves fertility and water retention, but also stores carbon for hundreds to thousands of years.

For India — a nation where agriculture and waste management intersect — biochar represents a powerful, scalable, and high-quality carbon removal solution.

The 2025 Criteria for High-Quality Carbon Dioxide Removal highlight durability and environmental co-benefits as essential principles. Biochar checks both boxes.

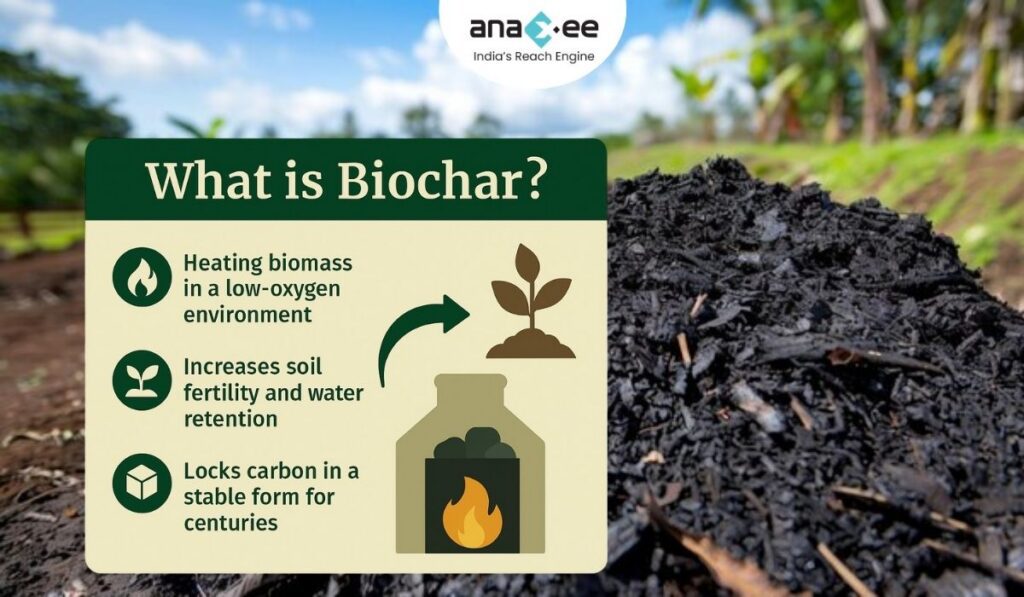

What Is Biochar?

Biochar is produced when organic biomass — crop residues, husks, twigs, or even municipal green waste — is heated in a low-oxygen environment. Unlike open burning (which releases CO₂), pyrolysis converts much of that carbon into a stable, solid form that resists decomposition.

When applied to soil:

-It enhances soil structure and nutrient retention.

-Increases microbial activity and root growth.

-Holds carbon in a stable state for centuries.

Simply put, it transforms agricultural waste into a permanent carbon sink.

Why Biochar Matters for India

1. Agriculture-Driven Economy

India’s 150+ million smallholder farmers generate vast crop residues. Many burn this biomass, contributing to air pollution and CO₂ emissions. Biochar converts that same waste into soil health and carbon credits.

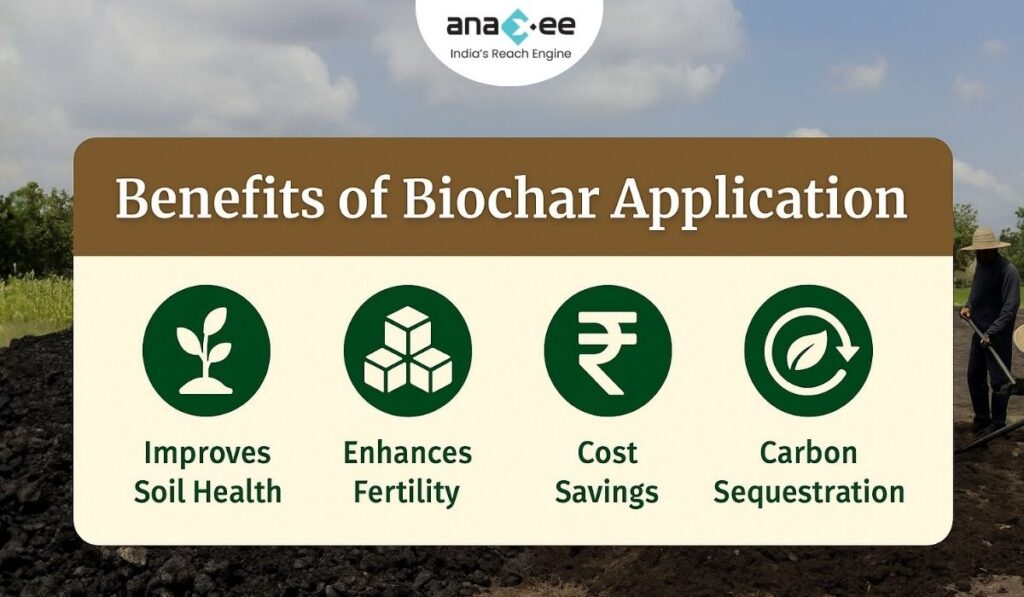

2. Soil Degradation Crisis

Over 30% of Indian soils are degraded or nutrient-depleted. Biochar improves organic matter, pH balance, and water retention — directly improving productivity.

3. Climate Commitments

Under India’s Nationally Determined Contributions (NDCs) and CCTS (Carbon Credit Trading Scheme), durable carbon removal like biochar will be crucial to long-term decarbonization.

4. Circular Economy Alignment

Biochar ties together agriculture, waste management, and carbon markets — converting local problems into revenue-generating, climate-positive outcomes.

Biochar and Soil Amendments: What’s the Difference?

While “biochar” often gets the spotlight, soil amendments is a broader category.

| Type | Description | Carbon Durability | Example Application |

| Biochar | Pyrolyzed biomass, highly stable carbon | 100–1000 years | Crop residue pyrolysis for farm use |

| Compost | Organic matter decomposition | 1–10 years | Manure or green waste for fertility |

| Enhanced Rock Weathering | Silicate mineral application capturing CO₂ | 100–10,000 years | Basalt dust on farmlands |

| Organic Manures / Vermicompost | Natural nutrient recycling | 1–5 years | Fertility boost, low permanence |

Biochar stands out for durability, but its synergy with other amendments (like compost or rock dust) maximizes soil and carbon benefits — a strategy Anaxee is deploying at scale.

What Makes Biochar “High-Quality” Carbon Removal?

The 2025 Criteria for High-Quality CDR define three pillars for durable removals:

1. Measurement and MRV

Every tonne of carbon must be quantifiable, traceable, and verifiable.

-Biochar MRV involves tracking feedstock type, pyrolysis temperature, and application rate.

-Anaxee’s dMRV system records all these in real time using mobile apps and satellite-linked systems.

2. Durability

Carbon in biochar is chemically stable. Studies show >80% of carbon remains sequestered after 100 years.

This makes biochar one of the most durable CDR pathways available today.

3. Environmental Co-Benefits

High-quality projects enhance soil health, reduce pollution, and improve yields.

Biochar projects align perfectly with climate justice and environmental integrity — avoiding trade-offs like monoculture plantations or fertilizer overuse.

The MRV Challenge (and Opportunity)

Biochar’s credibility depends on robust data — how much carbon is actually stored and for how long.

Traditional MRV struggles with:

-Inconsistent feedstock records

-Lack of local lab analysis

-Fragmented data management

Anaxee’s Digital MRV (dMRV) overcomes this through:

-Geotagged data on biomass source and pyrolysis unit.

-Automated reporting of application areas.

-Satellite imagery cross-verification.

-Blockchain-based data integrity (for future registry integration).

Result: Lower verification costs, faster credit issuance, and traceable impact.

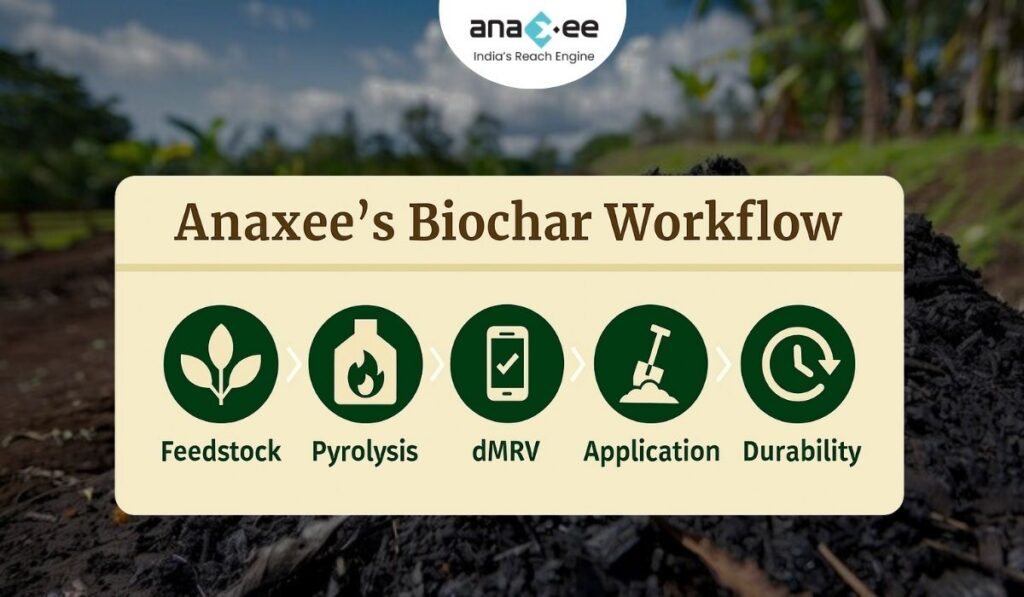

Anaxee’s Biochar and Soil Amendment Model

Anaxee integrates biochar into its Tech for Climate execution ecosystem, connecting farmers, technology, and markets:

1. Feedstock Collection via Digital Runners

-Rural Digital Runners mobilize local crop residue collection.

-Prevents burning and creates a carbon-positive supply chain.

2. Decentralized Pyrolysis Units

-Small-scale, locally operated pyrolysis units convert biomass to biochar.

-Supports village-level entrepreneurship.

3. dMRV Tracking

-Every batch of biochar is logged with feedstock details, GPS, timestamp, and application area.

-Farmers and buyers can trace carbon from field to registry.

4. Application and Soil Benefits

-Biochar applied on degraded farmlands increases yield, water retention, and soil carbon content.

-Results shared with buyers and verifiers through Anaxee dashboards.

5. Long-Term Durability

-Once sequestered, carbon in biochar remains stable for centuries.

-Regular satellite checks ensure no reversal or land-use change.

Anaxee thus bridges tech-enabled monitoring with community-centered implementation — ensuring carbon removals are real, durable, and fair.

Biochar in Carbon Markets

1. Growing Global Demand

Buyers like Microsoft, Shopify, and Carbonfuture are investing heavily in durable removals, including biochar. Credits fetch $100–$300 per tonne, far above typical forestry credits.

2. Emerging Methodologies

Standards like Puro.Earth, Verra’s Biochar Methodology, and Charm Industrial’s model are shaping a robust global market.

3. India’s Potential

With abundant biomass, low-cost labor, and supportive policy, India could become a biochar export powerhouse — provided quality and verification match global expectations.

Anaxee is positioning its projects to align with these premium markets, offering corporates traceable, durable, and community-positive credits.

The Co-Benefits: Climate, Soil, and People

High-quality biochar projects go beyond carbon:

| Impact Area | Description | Example |

| Climate | Long-term CO₂ sequestration, reduced burning | Avoids stubble burning emissions |

| Soil Health | Improved fertility, moisture retention, structure | Higher yields for smallholders |

| Air Quality | Eliminates crop-burning smoke | Cleaner air in rural belts |

| Livelihoods | Adds rural income via carbon finance | Farmer revenue + local jobs |

| Circular Economy | Reuses waste, reduces landfill | Biomass → Biochar → Soil health |

This is carbon removal that benefits both people and planet.

India’s Biochar Future

India’s next agricultural revolution won’t come from fertilizers — it’ll come from carbon-smart farming.

By 2030, India could:

-Produce 50 million tonnes of biochar annually,

-Sequester over 100 million tonnes of CO₂e, and

-Create millions of rural green jobs.

With the right infrastructure, MRV, and financing, biochar could become India’s signature carbon removal export.

Conclusion: Building Durability into India’s Carbon Story

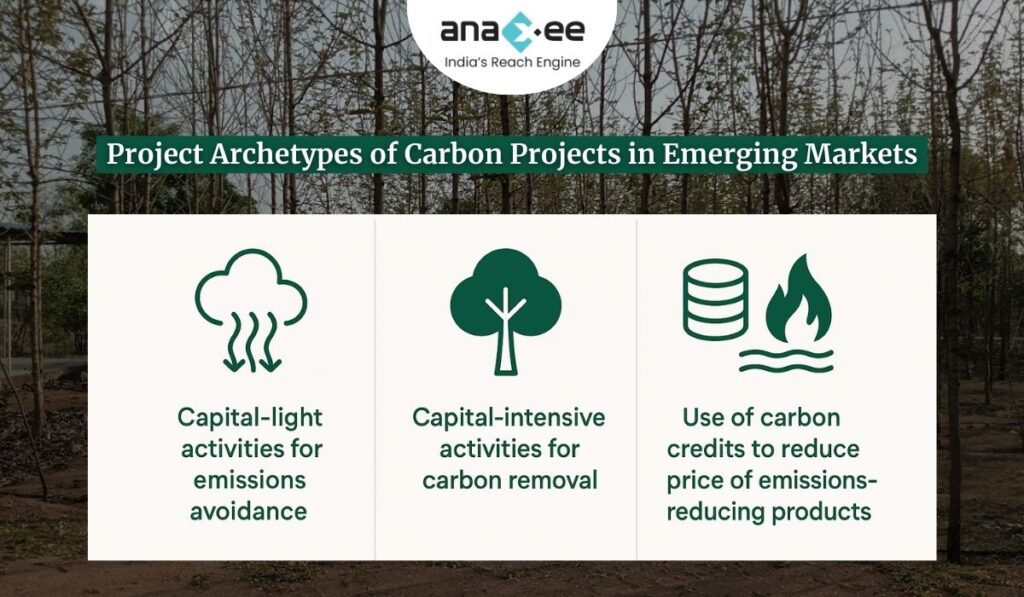

Carbon markets are evolving fast. The next wave is about durability, traceability, and co-benefits — not just offsets.

Biochar embodies all three.

The 2025 Criteria for High-Quality CDR call for long-lasting, verifiable, socially just solutions.

Anaxee’s biochar model — integrating tech, communities, and dMRV — shows how India can lead this frontier.

As carbon buyers shift from “cheap” to credible, projects like Anaxee’s will define the new gold standard.

👉 Call to Action

Partner with Anaxee to scale biochar and soil carbon projects that deliver durable climate impact and rural prosperity across India.

About Anaxee:

Anaxee drives/develops large-scale, country-wide Climate and Carbon Credit projects across India. We specialize in Nature-Based Solutions (NbS) and community-driven initiatives, providing the technology and on-ground network needed to execute, monitor, and ensure transparency in projects like agroforestry, regenerative agriculture, improved cookstoves, solar devices, water filters and more. Our systems are designed to maintain integrity and verifiable impact in carbon methodologies.

Beyond climate, Anaxee is India’s Reach Engine- building the nation’s largest last-mile outreach network of 100,000 Digital Runners (shared, tech-enabled field force). We help corporates, agri-focused companies, and social organizations scale to rural and semi-urban India by executing projects in 26 states, 540+ districts, and 11,000+ pin codes, ensuring both scale and 100% transparency in last-mile operations. Connect with Anaxee at sales@anaxee.com