Go-to-Market Execution: Why Retail Presence Defines Brand Success Beyond Advertising

In today’s crowded market, brands pour millions into digital ads, influencer marketing, and glossy campaigns. But here’s the hard truth: if your product isn’t visible on the retailer’s shelf, your GTM strategy has already failed.

Advertising might drive awareness, but execution at the retail level is what drives sales. This is the missing piece for many non-FMCG brands. Unlike FMCG giants, who’ve mastered their distribution playbooks, electronics, cookware, footwear, and other consumer brands still struggle to convert demand into actual purchases.

At Anaxee, we have seen this gap repeatedly. That’s why we focus on retail execution as the cornerstone of Go-to-Market strategies.

The Harsh Reality of Retail in India

Most brands assume:

-If customers see ads, they will walk into shops and demand the product.

-Distributors will naturally push their products to every retailer.

-Retailers will stock a brand because “consumers are asking.”

But what actually happens is very different:

-Retailers prioritize products they get on credit, consistently, and with better margins.

-Distributors play safe — they push only in shops they already know or where relationships exist.

-Competing brands fill the gap by capturing shelf space in unexplored outlets.

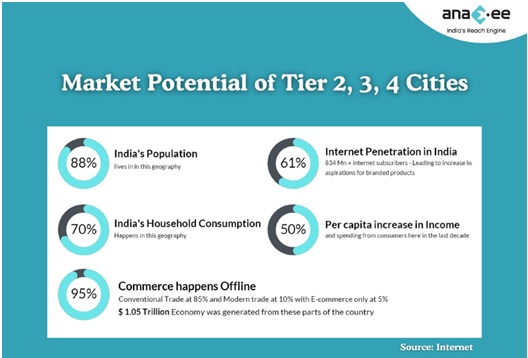

So while marketing budgets burn on digital impressions, many shops in Tier-2 and Tier-3 India don’t even stock the advertised brand.

Why Retail Execution is the True GTM

FMCG brands learned long ago that execution > advertising. Their GTM models focus on:

-Ensuring uniform sales across districts.

-Mapping and knowing every retail outlet.

-Beating credit/relationship biases through structured distribution.

-Expanding reach beyond city limits into talukas and rural hubs.

This same discipline is now critical for non-FMCG brands too.

The GTM Gap: What Brands Miss

No Shop-Level Visibility

Brands rarely know how many shops in a district even sell their category.Distributor Over-Reliance

Growth depends on the “comfort zone” of one or two distributors.No Data-Backed Strategy

Decisions are based on gut feel instead of shop-level analytics.Inconsistent Retailer Engagement

Without regular touchpoints, retailers prefer competitors who show up consistently.Marketing–Execution Disconnect

Ads may generate interest, but execution gaps leave retailers unable to fulfill demand.

Anaxee’s Solution: GTM as Retail Execution

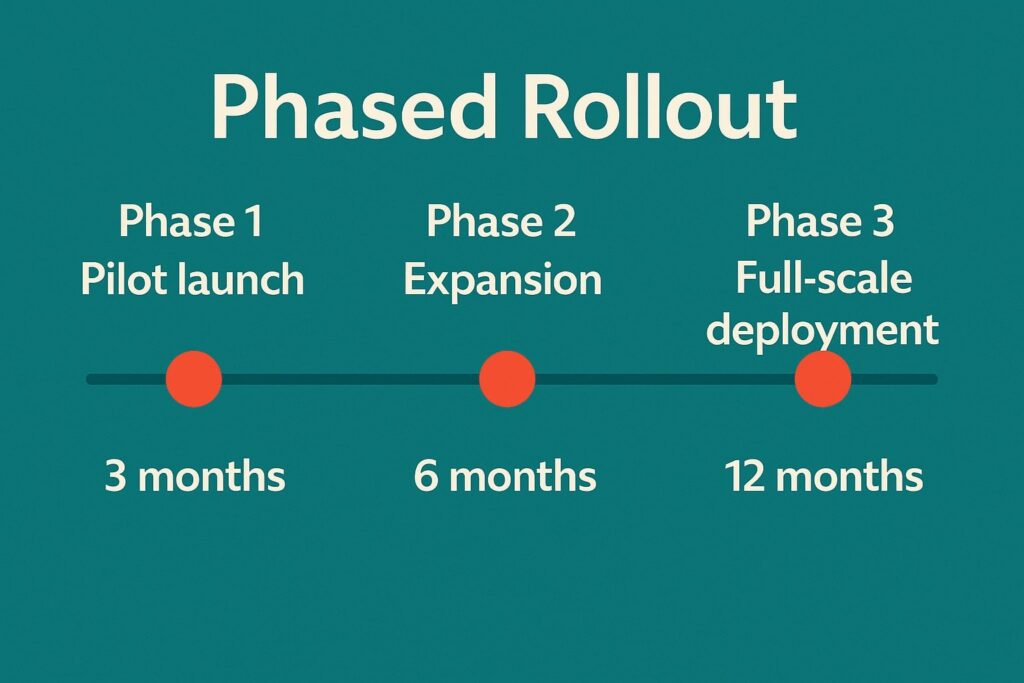

Our GTM framework works in three stages — each designed to bridge the advertising–retail gap:

1. Market Mapping

-Every shop in a district is mapped with GPS.

-Product categories and competitor presence are logged.

-Brands can see their real vs potential reach.

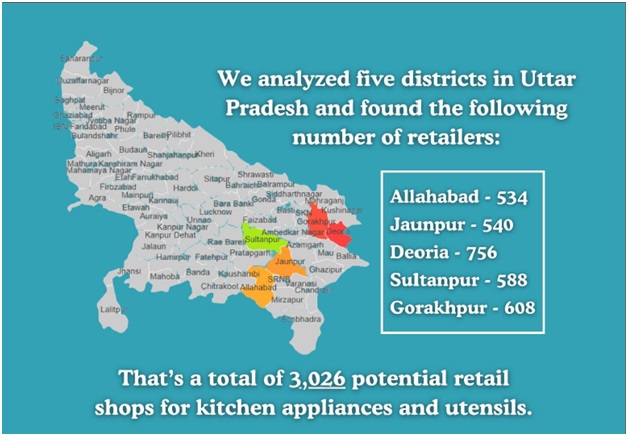

(Example: In East UP, Anaxee mapped 8,000+ shops across 27 districts, identifying untapped clusters that held 25–35% market share potential.)

2. Retailer Profiling

-Runners collect shop-level details: what brands are stocked, who supplies them, and what pain points exist.

-Profiling helps identify “hidden opportunities” — shops selling similar products but not stocking your brand.

(Case: In Prayagraj, only 140 out of 404 cookware retailers stocked a client’s brand. The remaining 264 shops became targeted opportunities.)

3. Order Taking

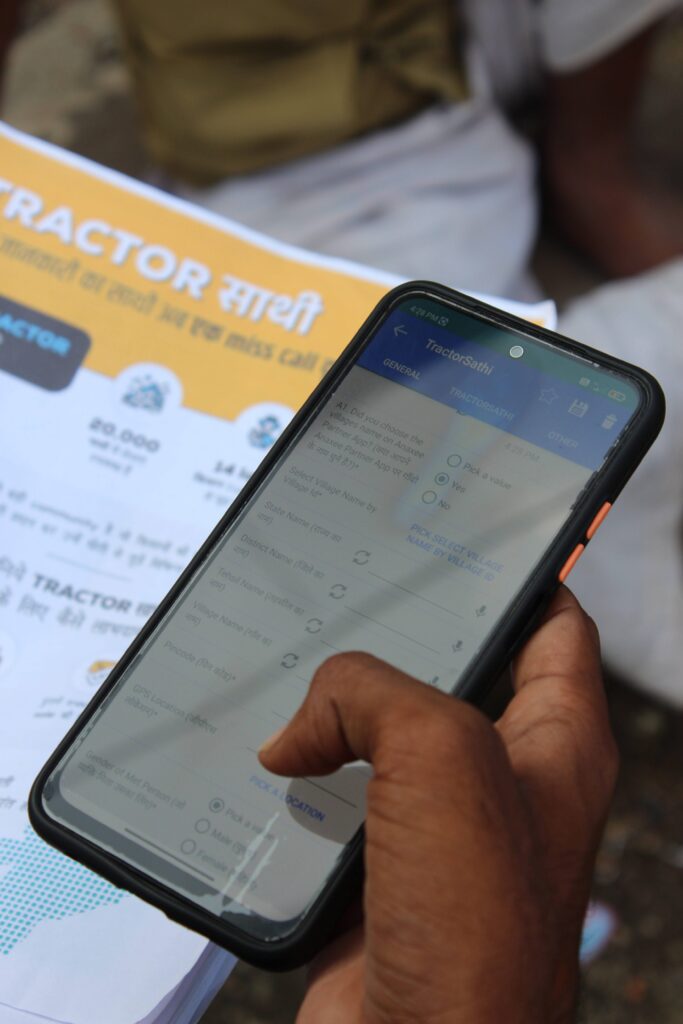

-Our runners don’t stop at profiling. They actively pitch, take orders, and expand SKUs stocked per shop.

-Regular visits convert “potential” shops into loyal partners.

-Orders are logged digitally, ensuring transparency and visibility.

Why This Model Works

Unlike traditional approaches, Anaxee’s model is tech-driven and execution-focused.

-Dashboards for Brands: Shop-level visibility, SKU tracking, district-wise analytics.

-Support for Distributors: Empowerment with data, reducing reliance on gut feel.

-Retailer Relationships: Consistent visits build trust and loyalty.

-Scalable Execution: Digital runners act as an extended GTM force.

Case Study: Ads Without Retail Execution = Lost Opportunity

One non-FMCG brand invested heavily in digital marketing for a product launch. Awareness campaigns ran on Facebook, Instagram, and YouTube. But when consumers went to local shops, retailers said: “We don’t have this product.”

Why?

-Distributors hadn’t supplied those shops.

-No one profiled which outlets to target.

-Retailers stocked competing products already visible.

Result: Millions spent on ads, zero ROI at retail.

After onboarding with Anaxee, the same brand saw:

-40% increase in district coverage.

-Order inflows from previously untapped towns.

-Uniform monthly sales instead of erratic bursts.

Benefits of Retail-Centric GTM

Ads Create Demand, Execution Captures It

Without retail presence, advertising is wasted.Distributors Become Partners, Not Gatekeepers

With data, distributors expand systematically.Retailers Gain Confidence

Regular engagement builds trust and loyalty.Brands Build Visibility & Market Share

Every shelf counts — more shops, more presence.Growth Becomes Predictable

Uniform sales across districts replace random spikes.

Moving Forward: GTM as a Growth Engine

The future belongs to brands that treat GTM not as a sales channel, but as a strategic growth engine.

At Anaxee, we believe:

-Distributors must be empowered.

-Retailers must be consistently engaged.

-Brands must have real-time visibility at shop-level.

That’s how FMCG companies won India’s markets. And that’s how non-FMCG brands can too.

Conclusion

GTM isn’t about flashy campaigns. It’s about ensuring your product is on the right shelf, in the right shop, at the right time.

Execution is everything. And execution at retail is where Anaxee makes the difference.

About Anaxee:

Anaxee is India’s Reach Engine- building the country’s largest last-mile outreach network of 100,000 Digital Runners (shared, tech-enabled feet-on-street). We enable brands, corporates, and agri-focused companies to break distribution barriers and scale their presence into rural and semi-urban India, covering 26 states, 540+ districts, and 11,000+ pin codes. Our technology-driven GTM solutions deliver on-ground activations, customer acquisition, lead generation, and project execution at unmatched speed and scale- while ensuring complete visibility and control over last-mile operations.

Alongside commercial execution, Anaxee also leads large-scale Climate and Carbon Credit projects nationwide. We provide the tech and field infrastructure to implement and monitor Nature-Based Solutions (NbS) and community projects like agroforestry, regenerative agriculture, and clean energy interventions, bringing transparency and verifiable impact to global carbon markets.

Want to scale your business or explore GTM partnerships?

Connect our sales team at sales@anaxee.com