Careers at Anaxee Digital Runners: Scale, Impact, and Learning in Action

Imagine your work reaching millions of people across India—whether through climate initiatives like tree plantation monitoring or community programs like vaccination outreach. At Anaxee Digital Runners, that scale isn’t a dream. It’s reality.

Who We Are

Anaxee Digital Runners Pvt Ltd is building India’s largest last-mile outreach network. With 40,000+ trained field agents (Digital Runners) covering 11,000+ pincodes, 430 districts, and 26 states, we combine technology with human presence. From climate monitoring and clean energy programs to commercial go-to-market projects, our reach is both vast and impactful.

Our work has been recognized nationally—Anaxee is a National Startup Award (2021) winner, validating the impact we’ve created across industries and communities.

Why Join Anaxee?

Choosing Anaxee means choosing real impact, fast learning, and diverse exposure. Here’s what sets us apart:

-Massive reach & scale: Work on projects spanning 11,000+ pincodes with 40,000+ Digital Runners.

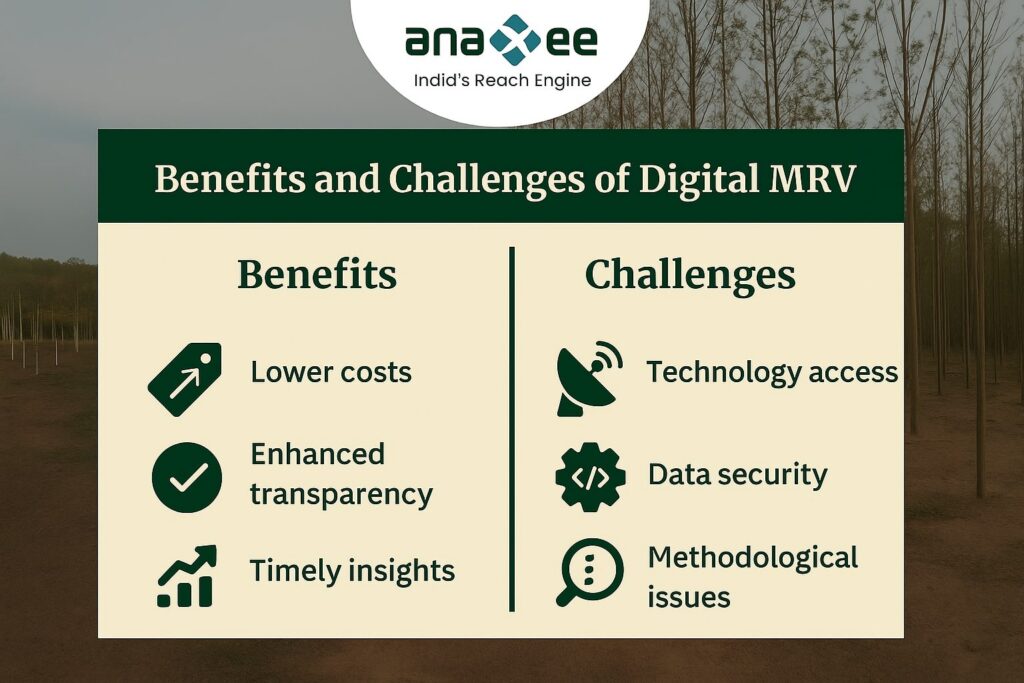

-Cross-domain projects: Get hands-on experience in climate (carbon projects, clean cookstoves, biochar, tree mapping) and commercial GTM campaigns for brands and startups.

-Startup energy + big-client exposure: Agile work culture with opportunities to engage national and international partners.

-Leadership access: Direct mentorship from CEO/COO and senior leadership, giving faster feedback loops and decision-making.

-Credibility & recognition: National Startup Award 2021, media features, and partnerships with global organizations.

What You’ll Work On

At Anaxee, no two days look the same. Our projects combine technology, field operations, and social impact. Some examples:

-Climate & Carbon Implementation: Tree-counting, polygon mapping, biochar project implementation, clean cookstove distribution, and carbon monitoring.

-Commercial GTM: On-ground campaigns for startups and brands, data verification, and hyperlocal customer engagement.

-Field Ops & Data: Managing Digital Runners, ensuring quality data collection, training field teams, and delivering dashboards for clients.

This cross-functional exposure helps you become T-shaped—deep skills in one domain with breadth across many others.

Impact Stories

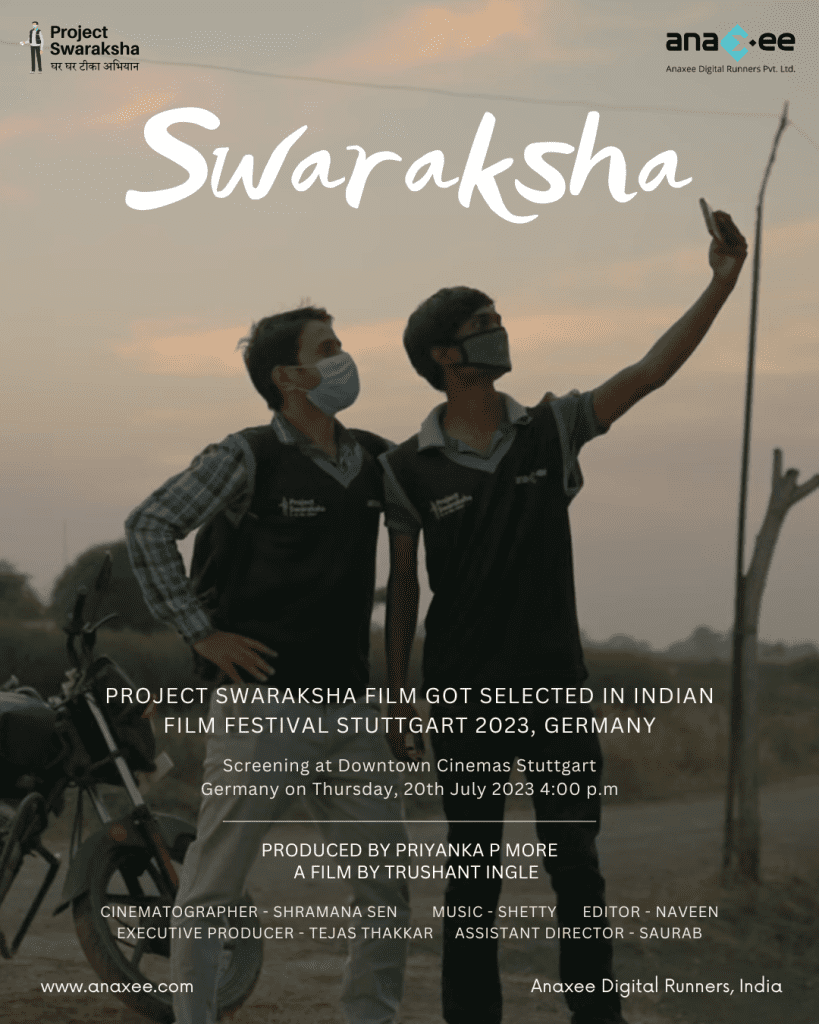

Project Swaraksha

During the COVID-19 vaccination drive, Anaxee deployed its last-mile network for vaccination counseling and outreach. Digital Runners went door-to-door, engaging with communities, clarifying doubts, and helping millions get vaccinated.

-Measurable outcome: Increased vaccination coverage in rural and semi-urban areas.

-Social impact: Communities trusted field agents, leading to stronger adoption.

-Recognition: The project was widely covered in media and praised for its reach.

This is just one example of how our network delivers tangible, life-changing results.

Growth and Learning at Anaxee

We believe growth is not limited to promotions—it’s about accelerating your learning curve and building real skills. Here’s what you can expect:

-Field Visits: See the ground reality, interact with communities, and understand project impact firsthand.

-Workshops & Training: Learn about emerging areas like biochar technology, clean cookstoves, carbon methodologies, and data verification.

-Cross-functional roles: Touch multiple domains—operations, client management, climate, and product.

-Mentorship: Work closely with founders and leadership for faster decision cycles.

Who Thrives at Anaxee?

We look for curious, adaptable, and impact-driven people. Ideal profiles include:

-Field Operations Managers: Skilled at managing distributed teams and ensuring delivery quality.

-Climate Project Leads: Interested in carbon projects, afforestation, clean energy distribution.

-Data & Analytics Specialists: People who want to combine field data with technology platforms.

-GTM Specialists: Creative problem-solvers who can run field campaigns for startups and brands.

-Generalists: Those who enjoy wearing many hats and learning across domains.

If you want exposure to both climate impact and commercial growth, Anaxee is the place.

Why This Matters: Social Impact + Career Growth

At Anaxee, your work has two-fold value:

- Social Impact: Whether it’s clean cookstove distribution, biochar implementation, or vaccination outreach, you’ll see real human outcomes.

- Career Growth: Exposure to big clients, cutting-edge climate projects, and startup agility builds credibility that accelerates your career.

This isn’t a narrow corporate role—it’s broad, hands-on, and deeply meaningful.

Career Pathways at Anaxee

We don’t offer one-size-fits-all jobs. Instead, we provide opportunities to grow across domains:

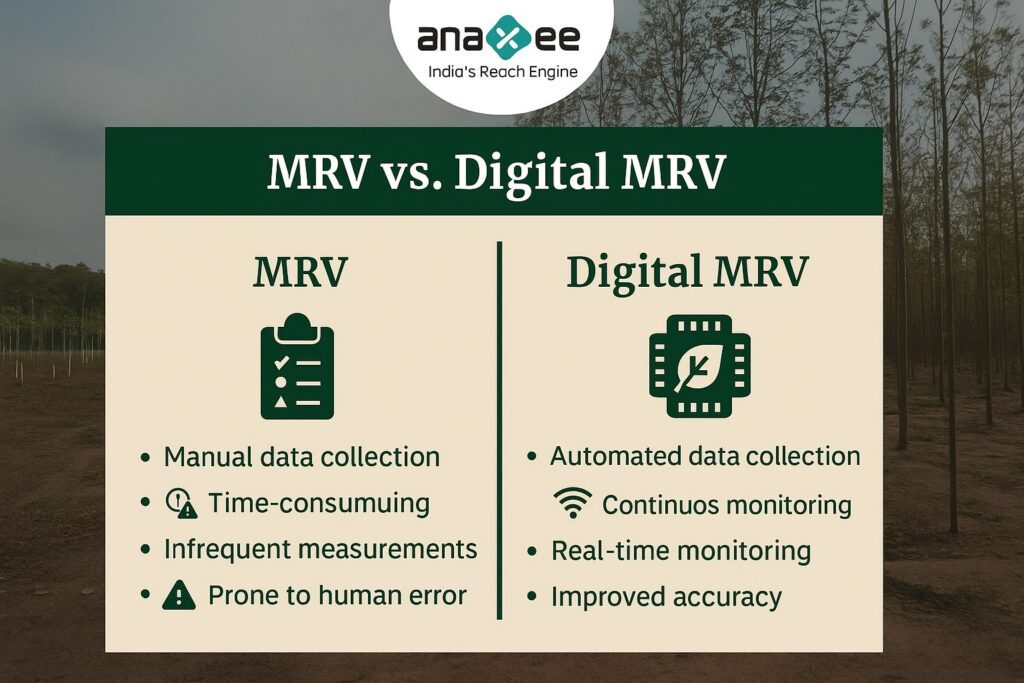

-Climate & Carbon Implementation: Learn methodologies like Verra, Gold Standard, biochar MRV, clean cookstove adoption tracking.

-Last-Mile Outreach: Design and manage campaigns across thousands of pincodes.

-Technology & Product: Work on apps and dashboards that track field progress.

-Client Delivery: Engage directly with national and international partners, presenting results and insights.

This mix ensures you’re not boxed into one role—you gain T-shaped career capital valuable for the long term.

National Recognition & Partnerships

Winning the National Startup Award (2021) gave us credibility in India’s startup ecosystem. But beyond awards, what matters is trust from partners.

We’ve been featured by Meta, collaborated with global development organizations, and executed projects at national scale. For employees, this means exposure to marquee clients while working in a nimble startup culture.

Our Culture

Anaxee combines startup agility with structured execution. Here’s what employees say:

-Open-door policy with CEO/COO.

-Transparent communication and ownership.

-Fast iterations—decisions are made in days, not months.

-Opportunities to design processes, not just follow them.

It’s a culture where learning and impact come first.

How to Apply

If this sounds like your kind of career journey, we’d love to hear from you.

📩 Send your resume to jobs@anaxee.com

Final Word: Why Anaxee?

Choosing a career here means choosing impact, growth, and ownership. You’ll:

-Work on real field programs touching millions.

-Balance climate and commercial projects.

-Learn faster through direct leadership access.

-Be part of a company scaling across India.

At Anaxee, you’ll wear many hats, take field trips, and see real community outcomes. More than a job, it’s a chance to be part of India’s impact story.